In the past few years, we have experienced a sudden upsurge in the number of investment mobile apps in the market. From legacy brokerages adding their own investment mobile solutions as another option for their clients to new startups dedicated solely to these mobile apps, people have started to see their true potential. These mobile apps are available on all major smartphone platforms and cater to the needs of seasoned traders and newbies who are just trying to get a little taste of the action alike. Depending on your investment goals, the features that are offered to you vary widely as well. If you are a beginner, you are given a handful of tools to ease you into this new world along with a lot of training material. But if you have a lot of experience under your belt, then these apps provide you a plethora of tools and ways to analyze the stocks of your choice and invest your money. But given their popularity, the market has become somewhat saturated with every app claiming to be the best. So we have put together a list of the top ten investment mobile apps in the market at the moment.

List of 10 Best Best Investment Apps

1. Robinhood

2. Acorns

3. Stash

4. Vault

5. Stockpile

6. TD Ameritrade Mobile

7. Wealthfront

8. E*Trade

9. Charles Schwab

10. Fundrise

1. Robinhood

Established in 2014, Robinhood was the brainchild of Stanford aluminis Vlad Tenev and Baiju Bhatt. It is a commission-free option for people to invest in stocks, cryptocurrencies, ETFs and options. While beginners can make use of the free service and the limited list of tools that it provides them while advanced investors can purchase the gold package and use the long array of professional and highly sophisticated investment tools for just $10 per month. With its easy-to-use-interface and simplistic yet effective design, Robinhood is without a doubt the heavyweight champion in this niche. But while it is the best mobile solution an advanced investor can ask for, it is, however, somewhat overwhelming for newcomers since it doesn’t do much to train them. So it is always a good idea to have some knowledge of investment and a set game plan before you start using this app.

Key Features

- Commission free trading

- Allows you to invest in Cryptocurrencies

- Streamlined interface

- A one stop shop for advanced investors

- The app also includes, customizable alerts, news feed, candlestick charts and ability to listen live to earnings calls

Download Robinhood App:

2. Acorns

Acorn is a robo-advisor that helps you save money and build up your portfolio without you even realizing it. Acorns majorly works on the spare change method. It requires you to link your debit or credit card to your Acorns account and then it rounds up your every purchase to the next dollar and then invest this spare change in Vanguard and BlackRock ETFs. Acorns allows you to open two different types of accounts- Acorn Core, which will be your standard investment account and Acorn Later, which will be your individual retirement account. Apart from the spare change method, you can also deposit money once or on a regular intervals in the account of your choosing. College students who have email ids that end with .edu can make use of Acorns for free for four years while others have to pay $1 per month for Acorns Core and $2 for Acorns Later.

Key Features

- An intuitive robo-advisor that does most of the work

- Uses spar change method of investment

- Allows you to open a standard investment account and a retirement account for as little charges as $1 and $2 respectively

- Provides free automatic rebalancing

- It’s Potential tool allows you to adjust the dollar amount invested to see how your total investments will do over time

Download Acorns App:

3. Stash

While Robinhood caters advanced investors, Stash helps beginners to learn investment basics with the help of its incredibly easy to follow, part game and part educational tool, called Stash Coach. It helps beginners in enhancing their knowledge of the investment realm by undertaking various demo challenges and keep track of their progress. Another thing that it does to enable beginners is suggest stocks for them based on the type of investment they want to do and how aggressive they want to be with it. Thanks to the ability of purchasing fractional shares, a user can start investing on Stash with a capital of $5 only. Also, for investors below the age of 25, retirement account is opened free of charge.

Key Features

- Allows you to invest as little as $5

- Has an educational module that trains new investors in a fun way

- Opens a free retirement account for investors below the age of 25

- Allows you to purchase fractional shares

Download Stash App:

4. Vault

While freelancing is cool and all, it is not without setbacks. And one of the biggest setbacks is that freelancers don’t get 401[k] plan. So as a result, they have to put together their own retirement plan and this is where Vault comes in. It allows you to open your IRA, Roth IRA and SEP IRA account to invest in. As soon as money is transferred to your account, Vault sends you a notification to approve the investment of a certain amount of your income that you selected while making an IRA account. On the other hand, you can automate the investment process as well without having to approve investment everytime you receive money.

Key Features

- Helps you to save or invest money as soon as you are paid

- Provides a streamlined user experience

- It helps freelancers in saving a fix amount of their pay cheque and invest it

- Low minimum deposit and monthly fee

Download Vault App:

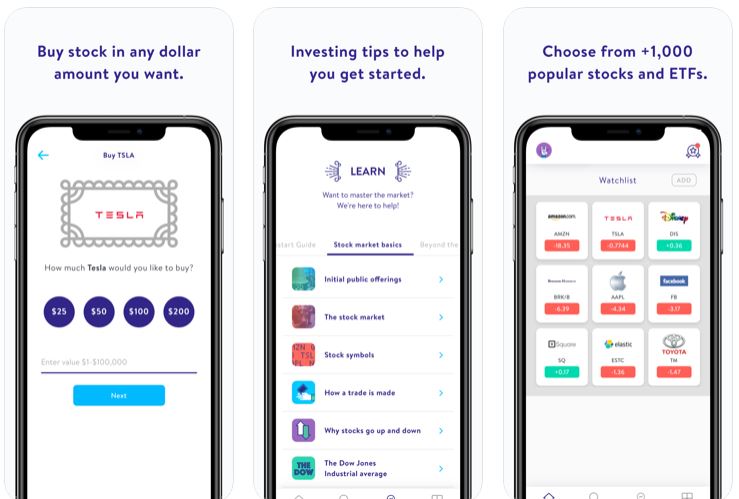

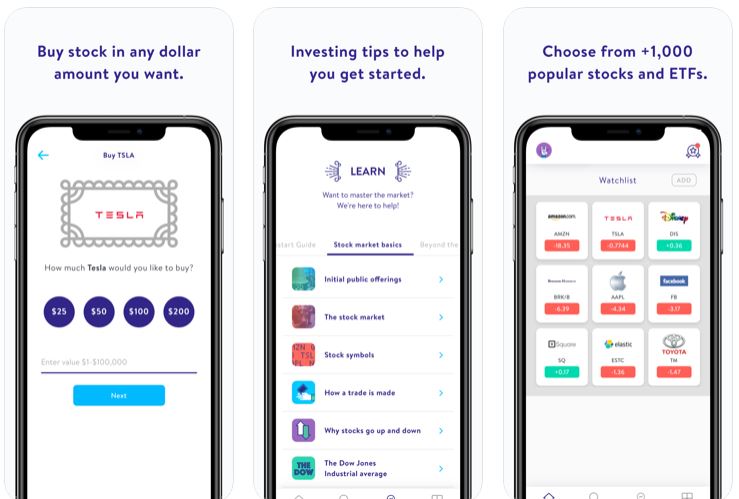

5. Stockpile

While there are many investment apps in the market for willing investors, there are, however, some apps for unwilling investors, too. Stockpile is one such app that allows you to invest in stocks. It allows you to purchase fractional shares and also, gift another account a stock gift card starting with $5. It is a great way for people to get their children interested in investing their money in stocks. By sending them a gift card in their Stockpile account instead of an eCommerce website where they’ll probably spend it in buying some frivolous thing they don’t need, you can teach them the importance of investing. You can gift them individual stocks as well and you can also put together a basket of stocks and send it along.

Key Features

- Follows the gift card module and allows you send shares as gifts to your loved ones

- Helps you in getting the young ones interested in investing

- Allows the purchase of fractional shares

Download Stockpile App:

6. TD Ameritrade Mobile

TD Ameritrade has two mobile solutions for its investors- the traditional TD Ameritrade app and TD Ameritrade Trading app. The traditional app is full of data about the stocks that you are interested in. This app is for investors who like to research about their stocks and want to plan their investments on their own. This app is perfect for that. It allows you to set notifications for breaking news and stock alerts as well. You can also see how your previous investments are doing, see your portfolio breakdown and make trades. The trading app is a mobile extension of TD Ameritrade’s trading platform Thinkorswim which allows a lot of customization powers to more advanced investors.

Key Features

- Works for both advanced investors and beginners

- Commission free module of trading

- High quality trading platform

- No account minimum

- Great research tools

Download TD Ameritrade App:

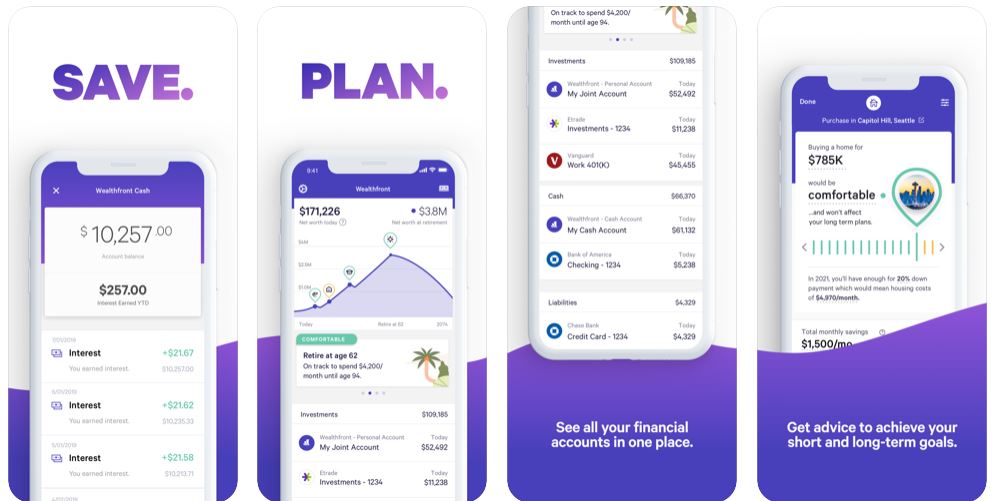

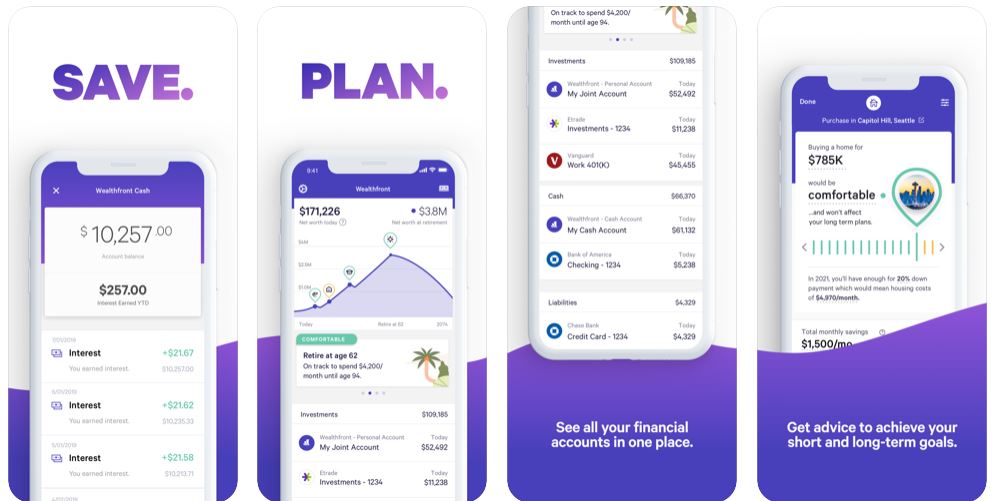

7. Wealthfront

If you don’t have the time to sit around and give investing all your focus, then Wealthfront is the perfect app for you. It is a robo-advisor that invests your money in a portfolio of ETFs and individual stocks. It requires you to answer some questions in the beginning and set your goals and risk-tolerance but after that, it can operate on its own. It invests according to its own AI and balances your portfolio automatically. You need $500 to open a brokerage account with Wealthfront and from there on 0.25% account management fee will be taken by Wealtfront.

Key Features

- Robust and free financial-planning tools for retirement, home purchase, college and travel.

- Allows you to link outside accounts.

- Portfolio line of credit also available.

- Streamlined user experience

Download Wealthfront App:

8. E*Trade

If you are an investor who likes to have a lot of options, there is no other tool better suited for you than E-Trade. It gives you thousands stocks, ETFs and options to invest in. The trading fee for most stocks can be anywhere between $0.75-$6.95. Apart from that, the app provides breaking news from T.V. channels like CNBC and Marketwatch and also allows you to set notification for stocks and create a watchlist.

Key Features

- Provides a lot of easy-to-use tools.

- Has a wide selection of investments

- Provides a great amount of research.

- Commission-free stock, options and ETF trades

Download E*Trade App:

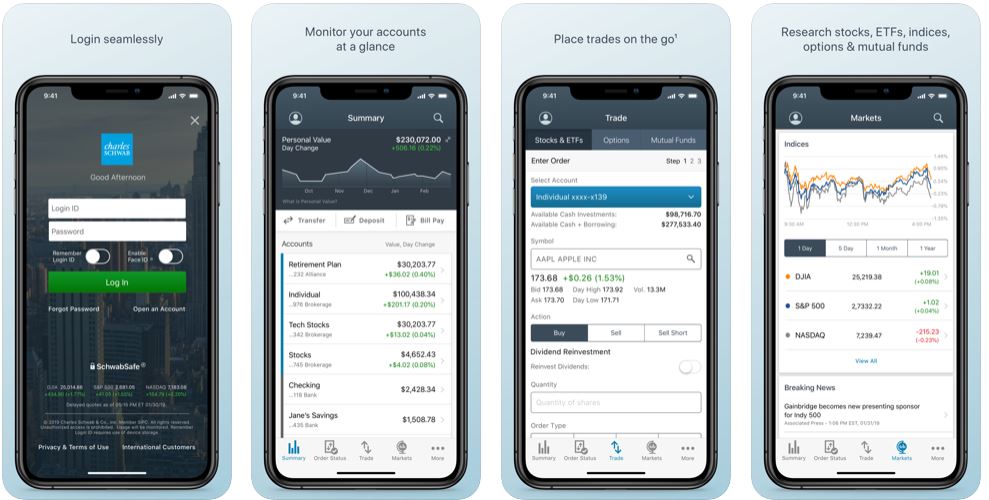

9. Charles Schwab

Based out of SF, Charles Schwab is a bank and a stock brokerage firm that was founded in 1971 by Charles R. Schwab. It is one of the top brokerage firms in the country and offers a robust mobile solution as well. It allows you to do in-app research and also has the functionality to deposit checks via mobiles. It also has a state of the art robo-advisor service that is free of cost which comes for a $5,000 commitment from the investor.

Key Features

- Provides free and extensive research

- A great robo-advisor service

- Has more than 4,000 no-transaction-fee mutual funds

Download Charles Schwab App:

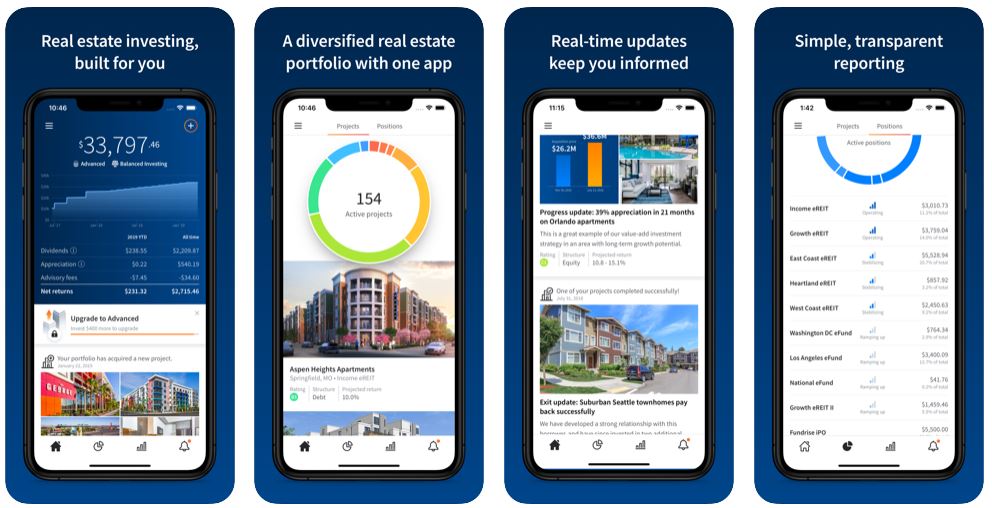

10. Fundrise

If you are looking to diversify your portfolio and shake things up a little bit by making some new investments, Fundrise is providing a perfect opportunity for you. It allows you to incorporate private real estate investment with your existing portfolio. The Fundros iPhone app makes accessing their account easier for its investors with an array multiple Login options. It sends them real time alerts about their Fundrise account thus always keeping them in the loop. The app also allows you to monitor your portfolio and stay up to date on all the latest news with the help of their newsfeed.

Key Features

- Very Low minimum investment requirement

- It welcomes all investors

- An easy to use iPhone app

- 90-day money-back guarantee

- IRA accounts also available

Download Fundrise App:

What to Look for While Choosing Investment Apps?

Some things that you need to keep in mind while you choose an investment app are,

- It should serve your purpose. Not all of these apps might be suited for you, especially if you are a beginner. You need to make sure that the app that you commit to has enough resources to cater to your investment needs.

- It must have good customer support.

- Check customer reviews on app stores. People are known to drop pits that you might sink into if you use a certain app.

- Not all apps allow you to invest free of cost. And also, while a lot of these apps are very reasonable, a lot of them, however, ask for big sums of money.

- How much can you invest plays a big role in your choice of an investment app. Some apps allow you to invest as little as $5 while some need you to commit at least $5,000 dollars.

Conclusion

Investing money is always a good idea. It allows you to get the most out of your money and start creating wealth. You are never too young to invest, as long as you know what you are doing. And even if you are busy and cannot track stocks all day or keep an eye on your portfolio and investments all the time, you can still invest thanks to these investment mobile apps. So choose an app that best suits you needs and start investing and see those returns coming in.