The banking and finance industry has been undergoing something of a digital awakening lately. In the past few decades, the industry has successfully integrated a plethora of different technologies in its processes to become safer, more streamlined, and provide better customer service. By employing fintech solutions, banks and other financial businesses are revolutionizing the industry. Furthermore, finance software development companies are using next-gen technologies such as AI and ML to build better solutions with more powerful features.

The consistent growth of the IT sector means new opportunities keep opening for fintech solutions. By using technologies like IoT and Big Data, banks can not only improve their inside-the-bank-experience but their online offerings as well. Furthermore, by integrating chatbots and predictive engines to their websites, they can improve customer experience and attract new customers.

There are countless other benefits and possibilities that come with the digitalization of the finance sector. And that is why, the majority of finance and banking institutions around the world invest in core banking solutions. In fact, according to the recent stats, the global digital banking sector is expected to reach $ 1610 billion by 2027. Furthermore, another study shows that the total number of online banking service users will be somewhere around 3.6 billion by 2024. These numbers clearly show that there is a mounting demand for next-gen fintech solutions and banks and other financial institutions are committed to meet that demand.

But if you have still not hopped on this bandwagon and are looking for the top core banking solutions for your business, then you’ve come to the right place. In this article, we will discuss what are digital banking solutions, talk about some of the next-gen technologies that are being used, and what are the top banking solutions.

What is Digital Banking?

With a significant change in the competitive market of the banking sector, and due to the customer’s fast-changing needs, banks and other such businesses need a modern and efficient banking system to thrive.

That’s where the digital banking solutions came into play!

Thanks to online banking services and other platforms, customers can engage with their banks securely and in a more streamlined manner. Furthermore, thanks to next-gen technologies, fintech solutions allow finance businesses to provide personalized services to each customer.

Here are some of the features that may usually come with a banking software created by a top-tier fintech software development company:

- Real-time Accounting

- Mobile Banking

- Digital Coupons and Cash Backs

- Dedicated Customer Portal

- Investment Banking

- Multi-Currency Support

- Funds Management

- Personal Finance Planning

- Secured Database

- Risk Management

- Loan Management

- Online Retail Banking

- Compliance Tracking

If you want to learn more about the features of core banking solutions, read more.

Next-gen Tech and Core Banking Solutions

The digital banking solution development market is ever-changing. As next-gen technologies become more sophisticated and easier to integrate, finance software development companies keep finding new ways to add them to their solutions. Businesses and customers are realizing the benefits of next-gen technologies and want to leverage them for simplified processes and interactions with one another.

Given below are the top next-gen technologies that are transforming core banking solutions:

1. Artificial Intelligence/Machine Learning:

With the help of AI and ML, the entire software development sector has made a giant leap forward. With the help of AI development services, banking and finance businesses can get robust fintech solutions for their internal and customer-facing operations. AI helps banks in fraud detection, data analysis, cyber security, process optimization, customer experience personalization, and countless other functions. An AI-based fintech solution also allows customers to perform their banking in a smarter way. AI is also essential for trend detection and advanced analytics. With the help of these operations, AI can further help banking and other such businesses make smarter and more informed marketing, business, and support plans.

2. Chatbots:

Chatbots are a necessary feature in almost all digital solutions these days, especially customer-facing. Research has shown that modern customers feel better when they get a more human interaction from customer support. Chatbots are built using AI and ML technologies and are capable of having organic conversations with the customer as a human would. In fact, the key idea inspiration behind chatbots is to mimic a human conversationalist. Chatbots are powerful and widely popular tools in almost all types of enterprise solutions, including fintech.

3. Internet of Things:

IoT or Internet of Things allows financial businesses to create a network of different net-enabled devices like printers, CCTV cameras, doors, etc., and control and govern them remotely. IoT provides a lot of critical real-time data that is used by banks to improve their services and internal processes. With the help of AI and other next-gen technologies, IoT’s real-time data can be used to make better business plans, improve employee productivity, cut down operation costs, etc. There are many developers that provide excellent and highly scalable IoT development services.

4. Mobile solutions:

While it is essential to have an online presence, having mobile solutions is just as important nowadays. The reason is simple; people are multi-taskers these days. They want to be able to do many things at one time. Like shopping while riding a bus or a train. Similarly, enterprise mobility services like a fintech mobile app allow users to do their bank work while they are on the move.

5. Cloud Fintech Solutions:

Effective cloud integration services are crucial in ensuring seamless and efficient communication between different cloud-based systems as part of a comprehensive cloud fintech solution. By integrating various applications, platforms, and services, cloud integration services enable banking and finance businesses to leverage the full benefits of cloud computing. With a well-integrated cloud infrastructure, businesses can streamline their operations, improve data accuracy and security, and enhance the overall customer experience. Therefore, when selecting a cloud fintech solution provider, it’s essential to consider their expertise in cloud integration services to ensure that your business achieves maximum value from your investment.

What are the Benefits of Digital Banking?

To get a clearer idea of what digital banking is and how it benefits the global banking sector, let’s take a glance at some of its benefits.

Ease of Transactions

The first and foremost benefit of leveraging fintech solutions is the ease of transactions. Banking enterprise solutions have made it easier for the customers to access their bank accounts and carry out transactions while sitting anywhere in the world. That has, in turn, reduced much of the tasks of the bank workers.

Regulatory Compliance

Often it is seen that banks are frequently asked by their finance ministry to submit various documents relating to their transactions, customer details, and other liquidity information. And most of the information is needed on an urgent basis. However, the banks struggled to fulfill those requests due to inadequate digital banking infrastructure. But, with proper resources, they no longer have to worry. They only need to filter the relevant information and download it using a few clicks to send it to the concerned authorities.

Improved Banking Operations

With automated banking software solutions, the banks can seamlessly improve their working operations and can enhance their customer services. Digital banking solutions have the capabilities to simplify complex banking processes and to provide a hassle-free working environment. Not only that, but the digital solutions can even help to mitigate various risks associated with banking operations and can ensure that banks work efficiently.

Secured Banking Data

Almost 25% of the people in Italy say that digital banking solutions are very trustworthy. Apart from providing ease and efficiency, fintech solutions also offer a secure working environment for the banking personnel. Stringent adherence to security features is one of banking enterprise solutions’ most critical and beneficial aspects.

Hassle-free Back Office Tasks

With robust features and automated functionalities of digital banking solutions, banks can efficiently simplify their back-office tasks like cheque clearance, drafts, customer applications, etc. Not only that, but these solutions also enable the banks to analyze various critical information of the customers to carry out different financial processes and accounting operations.

Enhanced Customer Satisfaction

According to a survey run by Statista, almost 56% of the users confirmed that digital banking solutions are easy and straightforward to use. Enhanced customer service is one of the crucial and most beneficial aspects of such solutions. The modern-day banking software offer nearly all the vital tools and information to your bank employees so that they can handle all the client issues with efficiency. Furthermore, the customers can get all the details of their account and past transactions even sitting remotely using the mobile banking applications. All that results in enhanced customer service and a happy customer.

Centralized Management

Last but not the least, digital banking solutions also help centralize all of a bank’s crucial information. Whether it is documents related to the customer accounts or customers information, the banking enterprise solutions allow banks to store them safely and efficiently. You can share the documents across the various departments of your bank and even a third part with one click and some controlled access options. All that results in streamlined banking operations and reduced workflow.

If you want to know more about digital transformation in the banking sector, read more.

What Are the Different Types of Core Banking Solutions?

While talking about core banking solutions, it is vital to know that there are majorly four types:

On-Premise

On-premise or desktop-based digital banking solutions are designed in such a manner that banks can install them within their existing infrastructure. These types of banking solutions are highly customizable and run on local servers of the banks. That means all the information is stored on the local server that the bank handles.

Web-Based

Next is web-based banking solutions. A third-party banking solution service provider offers these types of digital software. The customers and the bank employees can seamlessly operate these types of fintech solutions from anywhere around the world using a username and a unique password.

Cloud-Based

Cloud-based banking solutions are really popular these days. Cloud banking solutions store the data on a secure remote server to ensure maximum safety and continued availability. Almost all the trusted finance software development companies build cloud-based banking solutions. These solutions can also be offered as Saas (Software as a Service) to various banks.

Open Source

The last type of core banking solution is open-source software. In these types of banking solutions, the user can alter the code of the solution to match their business needs. They can modify and add extra plugins to enhance the performance of the fintech solution. The banks can leverage this type of banking solution when they are looking for specific features that are not provided by any third-party service provider.

Which Factors Should you Keep in Mind While Selecting a Suitable Banking Solution?

Finding a cost-effective and scalable banking solutions is not a piece of cake. But with enough commitment and time on your hand, you might be able to find the finance software development company as your strategic partner, if you are lucky. However, if you find it difficult to search for an ideal banking solution, do not worry; we are here to help you! Below are some of the questions you can ask yourself to get completely assured of your selected banking solution.

1. Does it include all the relevant features your financial institution requires?

2. Does it have a customization facility?

3. Are the features of the banking software user-friendly?

4. Is there a robust security system integrated within the software?

5. Is the software offering a great ROI?

6. Does the software provider have any experience in building banking solutions?

7. Will you get a customer support service post-launch?

8. Does the software run smoothly over desired platforms?

9. Can the service provider help you in developing a mobile app for your solution?

10. Is it cost-effective and flexible?

If the answers to all the questions mentioned above are yes, then there you go! You have the best banking software for satisfying your business needs.

Top Ten Core Digital Banking Solutions for 2022

So, here we are at the most awaited section of our article, the top ten most trending banking software applications for 2022. Now, without wasting any further, let’s quickly dive into the list of top banking solutions that you can leverage in 2022 to optimize profits for your bank.

EBANQ

EBANQ tops our list of the most trending banking solutions for 2022. It has user-friendly functionalities not only for the customers but also for the admins and other bank employees. Ideal for small and medium-sized banks, it comes with all the features needed you can possibly want from a banking enterprise solution, from digital payments and fund management to loan processing and customer support. The mobile apps for this software are available for both Android and iOS users.

Finacle

Finacle is yet again a powerful banking solution that efficiently addresses the core problems of the core banking, retail sector, and corporate sector of the global world. It offers an extensive range of comprehensive tools and web solutions to efficiently cater to every need of the users and power digital transformation strategies. You can seamlessly choose any dedicated banking solution from its extensive range that best fits your business needs.

CorePlus

CorePlus can be considered a complete banking solution available in the global market. It is one of the most affordable banking solutions designed especially for large banks and other critical financial institutions. Core plus encompasses all the critical features that your bank can leverage to optimize customer service and streamline your banking operations.

Mambu

Mambu is a Saas banking solution, meaning it is offered as Software as a Service (SaaS) to banks and other financial businesses. It is a helping financial tool that readily delivers business values in a constantly changing environment. It is a cloud-based fintech solution that scales efficiently with the growth of banks and other financial organizations.

Moneyspire

If you want to control your financial operations completely, then Moneyspire is the perfect fintech solution for you. It is a well-built and cost-effective personal finance software and accounting tool that small and medium-scale organizations can use. It is available in two versions (Windows and macOS) and it efficiently tracks all your dues, bills, accounts, and budgets to help your organization grow.

Holvi

Holvi is a modern digital banking solution designed for freelancers and entrepreneurs. It is a robust banking solution that offers tools like invoicing, bookkeeping, auto-expensing, etc., to help your bank grow. You can manage all your expenses, access your current account, invest your money in online business, and can even collect money from your customers using this software. What’s more? You can store all your documents in a centralized location!

Mifos X

Mifos is an elaborate core banking solution that helps banks and other financial institutions deliver a complete range of financial services. It is a robust banking solution that includes a client portal, a customer portal, and a centralized platform to carry out all the operations. The best part is that it is flexible enough to support any type of organization and product, service, or methodology. It is available as a mobile app, on-premise solution, and a cloud-based solution too!

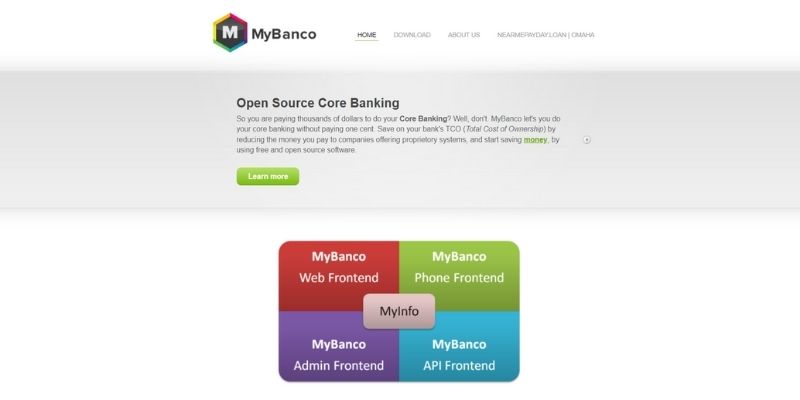

MyBanco

If you are looking for an open-source solution, then MyBanco is the perfect fintech solution for you. Having open-source software means that you can change the code with relative ease to make it apt for your business. Not only that, but the code you get with MyBanco is top-tier quality and is secure enough to pass through all the regulations of ASIC and FDIC. However, you need to be sure that you efficiently change the code to customize it and make it your own.

OpenCBS

OpenCBS is a web-based banking enterprise solution that enables your clients to seamlessly access the banking services from a remote location. It not only delivers high performance, but its PostgreSQL database also makes it faster and more responsive. The interface of this software is user-friendly, and its cloud-based version incorporates all the essential features that a user requires. In addition to that, the tablet version is also available that encompasses risk management and loan processing functionalities.

Cobis

Last but not least is Cobis. Cobis is a tech-friendly banking software solution that seamlessly meets your customers’ changing needs by quickly analyzing the latest market trends. It considers current market realities and helps you prepare efficient plans to help you effectively grow your business with time. Online payments, remittances, withdrawals, and seamless digital transactions are some of the robust features of the Cobis software.

Also Read- Financial Software Development: A Complete Guide for Businesses

Final Takeaway!

The banking and finance sector is changing at a great speed thanks to next-gen technologies. New and better banking solutions are released every year, making banking easier, safer, and more streamlined. The above-mentioned core banking solutions fit all business sizes and can cater to their most needs.

But if you want to develop your own fintech solutions, then look no further. Matellio is an experienced fintech software development company with the tools and the talent to develop robust and secure banking solutions. Our expert software developers excel at understand client needs and delivering a well-planned and designed solution that meets all their expectations and then goes beyond them. We provide scalable services for businesses of all sizes and our commitment to next-gen technologies allow us to build the financial software solutions of the tomorrow.

If you want to learn about our banking enterprise solution development services, you can book a free 30-min consultation!