Are you tired of constantly dealing with payroll errors that cost your business money and time? You’re not alone. In fact, according to the IRS, 33% of employers make payroll errors, costing billions of dollars annually. And even for companies that use traditional timecards, the American Payroll Association shows an error rate of 1-8% of total payroll. And all of this for what? For compromising efficient payroll automation services just to save a few bucks? As per the stats, this skimping may cost you heavy losses if you do not take a wise step soon.

Fortunately, with the advancement of technology, you can get a cost-effective automated payroll system built like many other businesses. It will help you streamline the entire payroll process and significantly reduce the risk of errors. In this guide, you will explore the procedures and techniques linked to payroll automation software. We will discuss the typical automation activities, the benefits of payroll automation compared to manual systems, the measures you can take to improve your current processes, ways to implement the software, and factors to consider when selecting a suitable payroll software development partner.

What is Payroll Automation?

It is a process that utilizes software to run payroll calculations and distribute payments electronically. You can accurately calculate employee wages and tax withholdings can be with the help of this software based on hours worked and relevant tax rates. The system can then deliver payments via direct deposit or printed checks.

In addition to automating payroll calculations, payroll automation software also helps keep payroll records organized and secure, manage employee benefits, and generate reports to evaluate the payroll process.

According to the Alight 2021 Global payroll complexity index report, many companies still rely on spreadsheets and paper-based activities for payroll processing. Automated payroll systems can improve these traditional processes by eliminating the need for paper documents and reducing ad-hoc spreadsheets and emails. By removing manual work, payroll automation enables faster and more accurate payment delivery, resulting in fewer errors and greater efficiency. These are just some of the many payroll automation benefits you can access after you get your software.

Features of An Automated Payroll System

The features offered by each provider vary based on their capabilities and digital transformation services. Nevertheless, the central functionality of automated payroll software generally focuses on streamlining or automating several HR and finance-related areas. These include

Employee Self-Service Portal

It is a crucial component of automated payroll software, allowing employees to access important information and simplifying operations for HR managers. Employees can view their payslips and update their personal information, including direct deposit information, within the payroll system. This two-way confirmation process saves time for the HR department and empowers employees to make necessary updates in real-time.

When you switch to payroll automation, you can include these operations in your system:

- Add, review, edit, and print their personal information

- Update their direct deposit details

- Access their statements

Accurate Time and Attendance Data

The automated payroll system can access a company’s attendance records and working hour system. This integration enables the automatic transfer of precise data related to time, attendance, and leaves into the payroll system without requiring manual intervention from employees or payroll specialists.

Seamless Payroll Reconciliation Process

Manual payroll processing makes verifying every step of the process difficult. However, when you switch to automation, you can do this effortlessly. It will significantly help you to make payroll reconciliation smoother. Additionally, payroll automation provides more reliable and accurate calculations based on a newly updated algorithm, thus improving the accuracy of the resulting data and analyses.

Several Reporting Types and Options

Different types and options for reporting are crucial in payroll management and making informed decisions. With detailed payroll reports, you can easily compare the data from the previous year to the current year and structure it better for future business purposes.

Automated payroll software comes with a variety of reporting options, including:

- Ad-hoc reports

- Management Information System (MIS) reports

- Provident Fund (PF) and Employee State Insurance (ESI) reports

- Payroll Reconciliation reports

- Customized Salary reports

- Statutory Acts reports

These reporting options provide a detailed insight into your company’s payroll data, making it easier to identify discrepancies and take necessary action. You can also add enterprise solutions to ensure your software meets your business requirements.

Effective Tax Management

Tax management is a crucial aspect of a payroll automation system. Filing taxes in compliance with regulations is challenging, especially when done manually. You can now easily automate a dedicated tax filing process to simplify the task.

Maintaining tax data and documentation for state agencies is crucial for payroll management. Using an automated payroll system, you can streamline and improve the entire tax process, from filing documents to submitting them.

Compliance Management

Much like tax management, compliance management is essential to the payroll process. Payroll automation ensures a compliant payroll process, which can be difficult and time-consuming with a manual system. Keeping up with payroll laws and regulations can be daunting, as they are subject to regular updates. A reliable payroll system can consistently update itself to comply with current payroll laws and keep your company informed.

Customization And Flexibility

The payroll management process can become more manageable using advanced and customizable tools that payroll automation offers. These tools include templates for letters, documents, and forms that HR personnel can easily download and customize to meet their needs.

Additionally, automated payroll software can offer customizable options for payslips, reports, and other templates to meet your specific payroll requirements. With this flexibility, you can scale the payroll process up or down according to your business needs and eliminate overhauling the manual payroll process.

Effective Budget Planning

A timely and accurate payroll system can assist in effective budget planning. By providing HR managers with information on HR expenses and budgets, they can better understand and plan for future costs. Further, timely salary distribution enables employees to plan their finances. This allows for better financial management and forecasting.

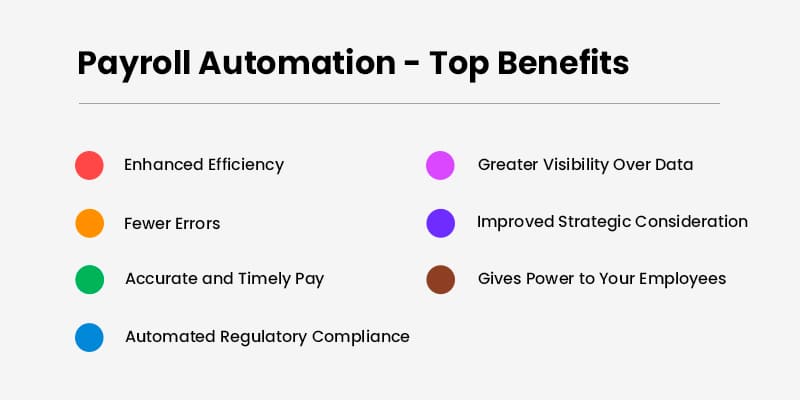

Benefits of Payroll Automation

At this point, you may have realized how automated payroll systems can alleviate stress and save you time. Therefore, it does not come as a surprise that the Global Payroll Management Institute has recognized payroll automation as a vital component of a business growth plan. Now, let’s summarize and further explore payroll automation benefits so you can hire dedicated developers and get the software developed quickly.

Enhanced Efficiency

Automated payroll systems increase efficiency by eliminating manual processing of various payroll tasks, which can be time-consuming and require more personnel. Automating calculations and processing payroll elements speeds up the process and reduces the time needed for the function.

Fewer Errors

Mistakes are common when handling large, diverse datasets requiring continuous manual calculations. However, automated payroll software significantly reduces the risk of errors. These systems use advanced technologies to compute everything based on a minimal initial dataset.

Accurate and Timely Pay

The legacy method involves the manual payment of employees by either an accountant or a payroll team. A survey shows that 49% of employees switch jobs because of payout errors. Your company is prone to such a risk if you completely rely on manual processes. Payroll automation guarantees that employees receive their payments accurately on the specified date, as the software automatically calculates all deductions and additions.

Automated Regulatory Compliance

Payroll automation ensures the timely submission of accurate reports to designated authorities. So, you can eliminate the need for manual submission and reduce the risk of penalties for non-compliance using automated systems.

Greater Visibility Over Data

Automated payroll systems can instantly generate reports, providing HR and finance teams with improved financial and employee data visibility. Therefore, automating the process is more efficient for your business than employing manual resources or an accountant, which can involve back-and-forth communication and can be time-consuming.

Improved Strategic Consideration

The level of data insight retrieved through payroll automation software can give you the power to make sound business decisions. Additionally, freeing up days each month allows you to focus on more strategic, longer-term recruitment, training, and growth initiatives.

Gives Power to Your Employees

A payroll automation system usually provides employees with their logins, granting them access to various information, such as payslips, annual leave, and performance reviews. Thus, adopting this software can reduce your workload and keep your employees informed, fostering mutual trust and boosting their overall performance and well-being.

Payroll Automation Process

The process involves software that automates employee payments and salaries. After building the software you can calculate employee wages, generate pay stubs, file taxes, and make direct deposits. Here is a step-by-step approach to how a typical payroll automation process works:

Step 1: Collect Employee Information

The first step in developing payroll software is gathering all the necessary employee information. The details usually include personal details, job information, tax information, and other relevant data of each employee. You can collect the said information through various methods, including online forms.

Step 2: Enter Employee Information into the Payroll System

Once you have all the necessary employee information, enter that information into the payroll system. You can do this manually or through automated data imports from other systems, such as HR management software. After you store employee information, the payroll software will save it securely.

Step 3: Establish Payroll Schedules

Next, you have to establish payroll schedules in your payroll automation system. Simply set the time slabs for paying the employees. You can schedule the payments as weekly, biweekly, or monthly. Apart from this, schedule direct deposit details for each employee while setting up payroll schedules

Step 4: Enter Working Hours

Ask your employees to maintain working hours record for each payment settlement period. You can either make them enter in and out daily or track their working hours through a time clock system of the payroll software.

Step 5: Employee Earnings Calculations

Calculate your employee earnings automatically using the software. It will accomplish this calculation based on their active working hours. This calculation will also include other payment aspects like bonuses, overtime, leave deductions, and more.

Step 6: Generate Pay Stubs

After calculating employee earnings, the payroll software will generate pay stubs for each employee. These pay stubs will include the employee’s gross pay, deductions, net pay, and other relevant details.

Step 7: File Taxes

The software will automatically calculate the taxes and settle them for each pay period based on the employee’s earnings and tax withholding information. It will then file the taxes on behalf of your company to the appropriate government agencies. Here, it ensures compliance standards without compromising your taxing schedules.

Step 8: Issue Direct Deposits

Once the processing of payroll and filing of taxes is complete, the software will issue direct deposits to each employee’s bank account. The automation helps ensure employees receive their pay on time and eliminates the need to distribute checks.

Step 9: Generate Reports

The final step in the payroll automation process is to generate reports. Payroll software can generate various reports, including employee earnings reports, tax reports, and year-end reports for tax purposes. These reports give you a detailed overview of the payroll process and enable your company to stay compliant with regulations.

Thus, introducing payroll automation in your business can help you save time and money as it streamlines your entire payroll process easily. You can invest your time in other important tasks by automating tasks such as calculating employee earnings, filing taxes, and issuing direct deposits. Moreover, you do not have to worry about compliance with tax regulations when you use automation. Lastly, the reports the software generates help you make informed decisions.

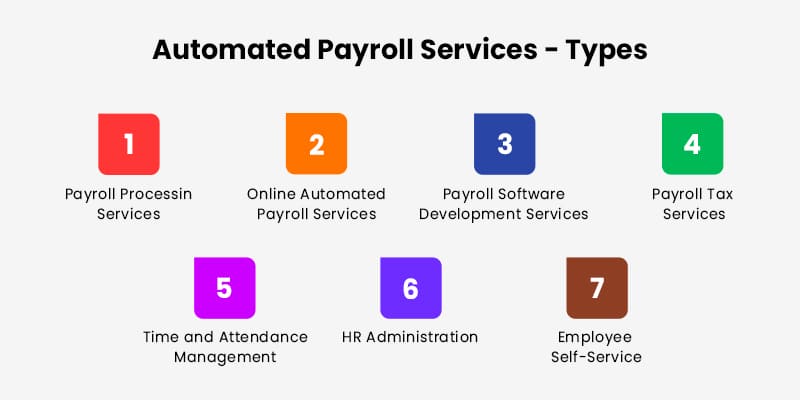

Types of Automated Payroll Services

When you seek payroll services, you ensure adhering to government regulations; that are mandatory for all types and scales of businesses. So, whether you are a startup, SME, or an established business, consider pursuing any of the below-given payroll services:

Payroll Processing Services

This involves hiring a third-party provider to manage all your payroll processing tasks, from payroll calculations to tax filings on behalf of your business. Seeking this service can help you save time and reduce errors in your payroll processing.

Online Automated Payroll Services

These services refer to cloud-based payroll software you can access via the Internet or online. The cloud software can handle various payroll tasks, including direct deposit and tax filings, accessible from anywhere with an internet connection.

Payroll Software Development Services

This is by far the best service you can seek for payroll management. You can get a comprehensive payroll automation software built that manages payroll processing, tax payments and filings, and HR services. This service can save your business time and money by outsourcing all payroll-related tasks to a single provider. Having your own payroll management system can provide exceptional benefits discussed in the later section.

Payroll Tax Services

It is to specifically handle payroll tax compliance, including calculating and filing payroll taxes on behalf of your business. You may opt for this automated payroll service if you only want to comply with tax regulations and avoid penalties.

Time and Attendance Management

It’s a service that tracks employee hours, including clocking in and out, managing PTO and overtime, and generating timesheets. Though it can help you manage employee attendance and ensure accurate payroll calculations, it will not offer the other vital services that comprehensive payroll management software provides.

HR Administration

This service involves managing employee data, including onboarding, benefits administration, tax compliance, and performance management. It is specific for managing employee information and ensuring compliance with regulations and may not involve critical payroll services.

Employee Self-Service

Accessing this service will allow your employees to view and manage their own payroll and HR data, including pay stubs, W-2s, and benefits information. However, the only task this automated payroll service can help you with is HR workload management.

Why Hire an Automated Payroll Software Development Partner?

While using ready-to-use payroll automation software is an option, hiring a partner for custom enterprise software development has multiple benefits. To point out some, these are the key benefits of getting your own payroll automation software built:

Customization

A development partner can customize the software according to the specific needs of your business, whereas selecting an app or web service may not offer the flexibility needed for your unique requirements.

Scalability

Collaborating with the right vendor can help you curate software solutions that can scale your business as it grows and changes over time. An off-the-shelf solution may not be able to scale dynamic payroll needs that are necessary to stay competitive for every business.

Integration

Hiring developers will empower your business with cross-platform integration of payroll automation software. These platforms could be HR management portals, accounting platforms, and time-tracking dashboards. This enables a seamless data flow between systems, relieving you from manual data entry and minimizing errors.

Support

Choosing a reliable development company for building an automated software system will provide you with ongoing support and maintenance. Continuous support ensures the resolution of issues quickly, keeping the software updated. You might miss this constant reinforcement when you go for an off-the-shelf solution.

Competitive Advantage

Custom-built payroll software can provide a competitive advantage in the marketplace as it takes responsibility for streamlining processes, increasing efficiency, and reducing costs.

Thus, you can gain greater flexibility, scalability, integration, support, and competitive advantage when you hire a development partner to build payroll automation software. This might not be the case when you work with ready-to-use software.

Case Studies

Matellio’s expert development team has a proven track record of developing and executing innovative payroll automation software. Here are a few solutions we built that offered our clients complete satisfaction:

Phoenix– An enterprise payroll management software.

Challenge: Develop a sophisticated website and application to simplify our client’s complex payroll management process.

Solution: Our expert developers built an automated payroll system that gathers all necessary data imported through the SAP framework, allowing for the generation of salaries. It includes features such as Approving Manager, Recent Changes, Submitted, Approved/Rejected, Time, Overtime, and Paid Time to address various managerial needs. It’s a cloud system that automates workflows and offers multi-currency support.

ZoomChecks– An account and bookkeeping application with payroll management.

Challenge: Streamline accounting for freelancers and SMEs

Solution: We developed a web application equipped with providing customized checks distribution. Freelancers, small business owners, and bookkeepers can easily customize their checks with chosen designs, logos, images, and other details. We incorporated QuickBooks integration and check-to-mail features to make the app highly efficient. These features automate the tasks like fetching data and sending multiple checks, helping the user save time and money.

Why Choose Matellio For Payroll Automation Software Development?

If you are tired of the endless paperwork and compliance issues that come with managing your payroll manually, it’s time to collaborate with us for automation! Our services in developing payroll automation software can simplify your operations, minimize expenses and save time while decreasing the likelihood of mistakes and penalties.

With the ease of integration, compliance with local regulations, ease of customization, upfront and ongoing cost savings, and scalability, our software solutions are the perfect fit for businesses of all sizes. Don’t let payroll management hold your business back. Contact us today to learn more about our software development services and transform your business operations.