From the last few years, we are witnessing the impact of technology in every aspect of our life, be it ordering food or e-learning. Digitized payments are no longer a buzzword today; instead, they have become part of our daily lives. Mobile wallets and payment apps have made it so easy, no?

P2P apps are one of the most effective methods for sending and receiving money. These apps have gained more popularity compared to other payment solutions.

In this article, we will walk you through a step-by-step guide of the P2P App Development Process.

But, let’s first understand the definition of P2P Application.

Scroll Down!

What is a P2P Payment App?

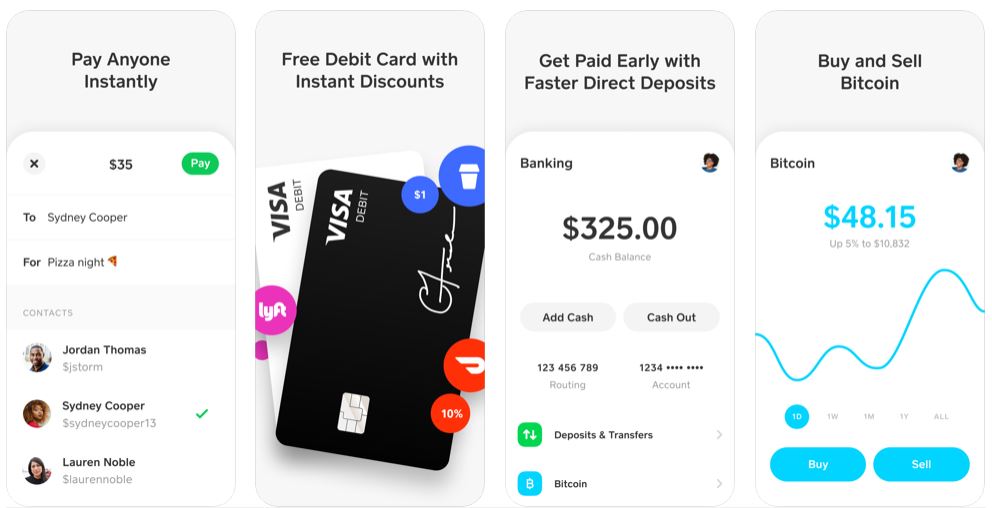

P2P Payment App provides a platform where individuals can directly transfer money to their friends and family via their linked bank accounts. Secure money transfer, fantastic offers, cashback are some of the benefits of this solution.

The app doesn’t directly interfere with banking systems and credit cards; instead, it avails the financial services provider API.

Step-by-Step Guide of developing a P2P App

1. Start your app with Local Market

The first step should always be small. Beginning with a local market will allow you to launch an MVP. This way, you can analyze how the market is responding to your app. Another perk of starting local is that you wouldn’t have to worry about competing with giants like Paypal.

2. Pay Attention to Security

When it comes to data and money, security is everything. Remember, an app with standard UI/UX, but robust security will do a lot better than a visually appealing application prone to security breaches. For better safety, get certified from recognized brands to ensure seamless services. Leverage following pointers to develop a robust P2P Solution-

- Face Recognition and Touch ID are some of the ways to secure the application.

- Prompt notification for instantly notifying users of all the transactions.

- Passwords are still easy to hack. Leverage 2-factor authentication as the methodology saves the application from hacks and frauds.

Comply with PCI DSS regulatory standards. These data standards have been availed by major companies like Mastercard, VISA, JCB internationals, American Express, and others.

3. Try Experimenting with 3rd party APIs

Investing a tremendous amount of money into developing bells and buttons that may or may not be successful isn’t a very good approach. This is where 3rd party APIs come to the rescue.

These APIs help in accomplishing different tasks; for instance, Dwolla API permits integration with the US Banking System, and Synapse API helps in managing compliance and building secured accounts.

4. Decide the nature of your P2P Solution

Basically, there are three kinds of apps- Web, Native, and Hybrid

A payment app is recommended to be native in the design. Also, native applications are preferred worldwide. Even the major brands opt for native applications. Take, for example, Facebook; the social media platform works very similarly on Android and Apple. Although on close observation, you are going to spot certain differences.

A native application will offer a better way of navigating due to refined UI/UX.

Read More: Discover how partnering with a P2P lending platform development company can revolutionize your fintech business by streamlining lending processes and enhancing user experiences.

5. Technology Stack

There are two platforms on which apps are developed- iOS & Android-

- Android

Language– Java

Tools– Android Studio, Eclipse

- iOS

Language– Obj C or Swift

Tools– Intellij Appcode, Apple XCode

6. P2P App like Square Cash must include following Features

- Linking Bank Accounts

- Money Transfers

- Pay Bills

- Multi-factor authentication

- Recharge Accounts

- Foreign Exchange

- Lending System

- App Wallet

- Cross Border Transfer

7. Have you decided on Monetization Strategy yet?

If the answer is no, then you have to get this one straight! No app ever becomes successful without a proper monetization strategy. A robust revenue model ensures steady capital flow and higher profits. The capital structure is essential for any business to drive success.

Overall, there are two ways for deciding on the revenue model of your app-

-

Premium Account

Premium mode will allow your users to leverage features like transactions, fund transfers, etc.

Features like Cryptocurrency transactions, chatbot, currency conversions, text messaging should be offered in the premium version.

-

Pay-per-Click

Create a space on your app for banners. Ask the financial institutions for displaying products on your app, so that a click on it will generate revenue. This technique is called Pay-per-Click, and it is a widely used technique for generating revenue.

8. Customer Support is a must!

There is only one way of gaining trust amongst your customers and i.e., by helping them. Providing round-the-clock support via online chats, emails, calls, etc. are some of the ways for building trust amongst your customers. Remember, answering customers’ queries timely is essential as delayed responses are not considered to be good practice.

Take Home Message

Stepping into the ocean of P2P App development is a huge challenge, but with proper measures, it can prove to be the deal-breaker. Only you, as an entrepreneur, can decide whether you wish to turn this wisdom into a prized product or let it slide as just one another idea.

Need some assistance?

Contact Matellio. We have a team of experts who have experience developing web and mobile applications for varied industry verticals. Share your requirements, and our experts shall craft a robust, secured, and feature-rich P2P solution.

Till then, Happy Reading!

Disclaimer: Please note that the content of this blog including links, texts, images, and graphics is only meant for informational purposes. We do not intend to infringe any copyright policy or do not possess any third-party material. If you have issues related to any of our content or images, kindly drop your message at info@matellio.com