Let’s get real. If your customers can’t pay quickly, securely, and effortlessly on your site, you’re losing money—every single day. A poor or outdated eCommerce payment gateway integration is one of the biggest reasons behind cart abandonment, frustrated users, and shrinking sales. If your competitors have mastered this, why haven’t you?

Your payment gateway system isn’t just a tool; it’s the backbone of your online business. Yet, most eCommerce owners underestimate its power until it’s too late—until customers leave mid-checkout, until your support team drowns in complaints, and until revenue starts slipping through the cracks. This isn’t just your struggle.

Countless eCommerce businesses faced the same challenges—until they adopted robust payment gateway integration services. The results? Faster transactions, happier customers, and skyrocketing conversions.

At Matellio, a trusted digital transformation services provider, we don’t just ‘integrate’ payment gateways. We transform your entire payment gateway in eCommerce process into a seamless, secure, and user-friendly experience—one that customers trust and return to.

If you’ve been ignoring this critical piece, now’s the time to act before your competitors leave you behind. Stay with us, and I’ll show you exactly how the right eCommerce payment gateway integration can save your business, solve your biggest payment challenges, and set you up for unstoppable growth.

The Hidden Challenges of Payment Gateways That Are Hurting Your eCommerce Business

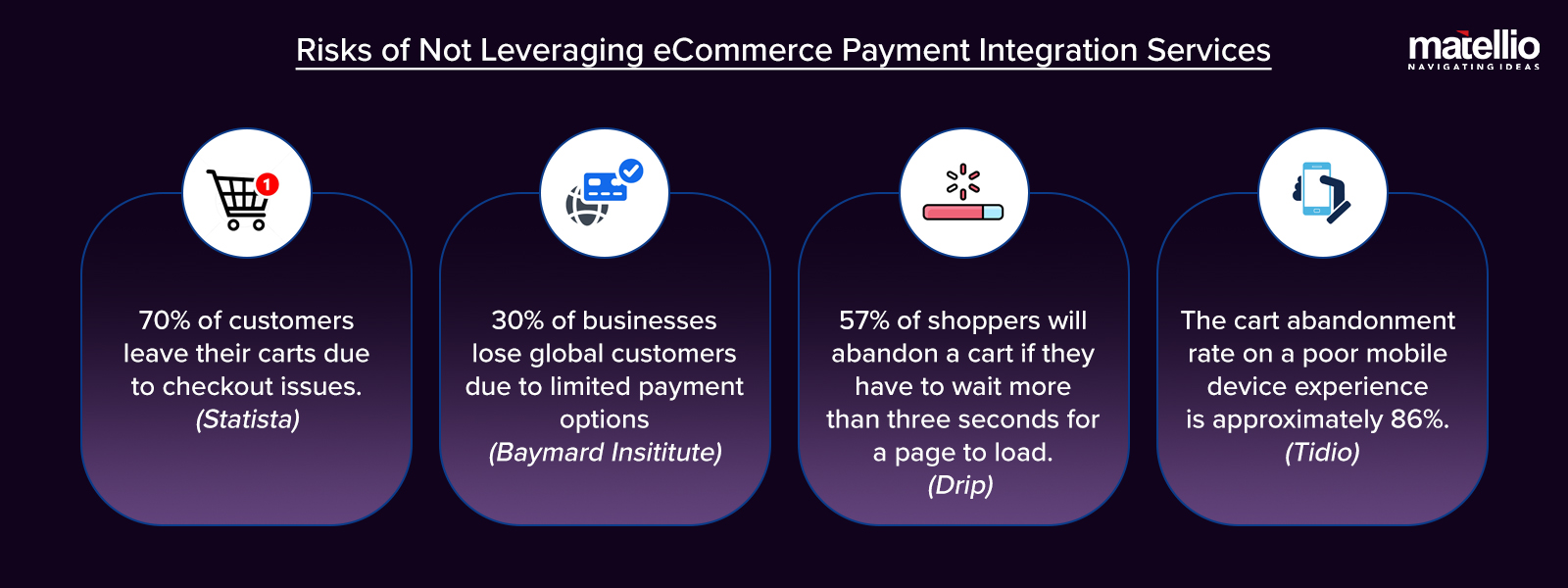

If you’re still wondering why your cart abandonment rates are soaring or why customers leave your site before completing payments, let us be honest: your eCommerce payment gateway integration might be the culprit.

A payment gateway system that’s slow, outdated, or misconfigured isn’t just inconvenient—it’s a silent revenue killer.

Cart Abandonment Due to Payment Failures

Nothing frustrates a customer more than reaching checkout and facing a failed payment. Slow loading times, transaction errors, or an unresponsive payment gateway in eCommerce can instantly push your customer to your competitor.

- Payment failures cause nearly 70% of abandoned carts, leaving you with lost sales and wasted marketing costs.

- If your eCommerce payment gateway isn’t optimized, you’re losing money, customer trust, and repeat business.

Limited Payment Options—Losing Global Customers

Customers expect choice. A modern eCommerce store needs more than just one or two payment options. If your site doesn’t support multi-currency transactions, digital wallets, or BNPL (Buy Now, Pay Later), you’re turning away valuable customers.

- Global shoppers abandon sites that don’t offer flexible payments.

- A tailored eCommerce payment gateway integration ensures seamless transactions across all payment modes—cards, wallets, UPI, and more.

Security Risks and Customer Distrust

A poorly implemented payment gateway system exposes your eCommerce software development project to fraud, data breaches, and trust issues. Do you think your customers will come back if they don’t feel safe?

- Without secure payment integration services, you risk losing sensitive customer data and your reputation.

- Leading payment gateway integration services include PCI-DSS compliance, fraud detection, and encryption, ensuring safe and secure transactions for your customers.

Payment Delays—Damaging Your User Experience

Modern customers demand speed. A payment gateway integration in eCommerce that lags during transactions or causes delays damages user experience, leading to frustrated customers who never return.

- Fast and seamless payment gateways integration ensure real-time transactions.

- Delays lead to failed conversions, poor reviews, and an eCommerce store that bleeds revenue.

Incompatibility with Mobile Devices

Did you know that over 68% of eCommerce transactions happen via mobile devices?

If your payment gateway integration isn’t mobile-friendly, you’re locking out the majority of your audience.

- A modern eCommerce payment integration ensures compatibility across platforms—mobile apps, web, and tablets.

- Partnering with an expert payment gateway integration company ensures a smooth experience for mobile shoppers.

Lack of Scalability for Growing Businesses

As your business grows, your payment gateway must grow with it. Outdated systems struggle to handle high transaction volumes, leading to crashes during peak times like Black Friday or holiday sales.

- A scalable eCommerce payment gateway integration ensures your site runs flawlessly under heavy traffic.

- Advanced cloud integration services ensure your payment systems scale effortlessly, future-proofing your business.

If you’re still relying on subpar eCommerce payment integration, you can also be in the same list:

Your eCommerce business cannot afford to lose customers over a broken payment experience. Every second counts. Every failed payment costs you money. But here’s the good news: all of these challenges can be resolved with the right payment gateway integration services—and that’s where Matellio comes in!

How a Robust Payment Gateway Integration Can Transform Your eCommerce Business

Imagine this: a customer lands on your eCommerce site, adds products to their cart, heads to checkout, and completes the payment—smoothly, securely, and within seconds. No errors, no friction, no abandoned carts. Now imagine hundreds, even thousands, of customers having this same flawless experience on your platform. That’s what happens when you invest in a professional eCommerce payment gateway integration—and that’s how your business starts winning.

In the fast-paced world of eCommerce, every second, every click, and every failed payment matters. Businesses that overlook their payment gateway integration in eCommerce lose more than sales—they lose trust, customers, and market share.

But those who embrace modern, scalable payment gateway systems see their businesses transformed into conversion machines.

Higher Conversions Through Faster, Hassle-Free Transactions

A robust eCommerce payment gateway eliminates delays, reduces checkout abandonment, and ensures transactions are completed within seconds. A seamless payment flow isn’t a luxury—it’s a necessity to drive conversions.

Expand Globally with Multi-Currency and Multi-Payment Support

If your payment gateway system doesn’t support global customers, you’re limiting your revenue potential. Today’s eCommerce buyers expect options—credit cards, wallets, UPI, BNPL (Buy Now, Pay Later), and even cryptocurrency.

A modern payment gateway integration in eCommerce enables your store to process payments from customers anywhere in the world—securely and efficiently.

Build Customer Trust with Enhanced Payment Security

Trust is the backbone of every online transaction. If customers feel their data is at risk, they’ll abandon the payment process instantly. A secure payment gateway in eCommerce is essential to protect sensitive data and build long-term customer confidence.

Matellio ensures your payment systems are PCI-DSS compliant, encrypted, and fraud-proof, turning your eCommerce site into a trusted platform customers rely on.

Real-Time Transaction Processing for Better User Experience

The speed of your eCommerce payment integration directly impacts customer satisfaction. Delays, errors, or failed transactions frustrate users and damage your brand reputation. A reliable payment gateway system ensures real-time processing, no matter the volume.

Real-time payment processing means instant confirmations, satisfied customers, and repeat business.

Handle Peak Traffic Seamlessly with Scalability

Picture this: your eCommerce site is flooded with visitors during a major holiday sale. Without a scalable payment gateway integration, your system crashes, customers leave, and your revenue takes a hit.

Mobile Optimization to Capture the Majority of Users

Many eCommerce transactions happen on mobile devices, yet many payment systems fail to deliver a seamless experience on smartphones and tablets. Mobile-optimized payment gateways integration is non-negotiable.

See the Results for Yourself

Companies that invested in professional payment gateway integration services saw a 25% decrease in cart abandonment, a 35% increase in completed checkouts, and significantly improved customer satisfaction. These aren’t just numbers—they’re real results that businesses like yours are achieving right now.

The time to act is now! Partner with Matellio today and watch your business thrive. Submit RFP to get started!

Key Features to Look for in eCommerce Payment Gateway Integration

Not all payment gateways are created equal. If you want your eCommerce store to succeed in today’s competitive market, your eCommerce payment gateway integration must include features that improve user experience, build customer trust, and optimize your business operations. Here’s what you should absolutely prioritize when implementing or upgrading your payment gateway system.

PCI-DSS Compliance for Maximum Security

PCI-DSS Compliance for Maximum Security

Your payment gateway system must comply with PCI-DSS (Payment Card Industry Data Security Standard) to ensure customer payment data remains secure. PCI-DSS compliance adds encryption layers to prevent fraud and data leaks.

Without PCI-DSS compliance, your platform becomes vulnerable to security breaches, which can erode customer trust and lead to legal penalties.

Multi-Payment Options to Cater to Every Customer

Multi-Payment Options to Cater to Every Customer

Ensure your payment gateway integration supports multiple payment methods, including credit/debit cards, digital wallets (like PayPal, Apple Pay), UPI, and Buy Now, Pay Later (BNPL) services.

Today’s customers expect flexibility. Offering multiple payment options reduces cart abandonment and encourages repeat purchases.

Mobile Optimization for Seamless Payments

Mobile Optimization for Seamless Payments

Since over 68% of eCommerce transactions happen via mobile devices, your payment gateway integration in eCommerce must be optimized for mobile platforms. Payments should be fast, responsive, and user-friendly across smartphones and tablets.

Integrating mobile-optimized gateways is a priority in modern eCommerce app development, helping you cater to mobile-first shoppers and drive higher conversions.

Multi-Currency Support for Global Expansion

Multi-Currency Support for Global Expansion

To cater to international customers, your eCommerce payment gateway should handle transactions in multiple currencies. This eliminates friction for cross-border buyers and enables a localized experience.

Multi-currency support ensures your platform can scale globally, attracting customers from different regions without payment barriers.

Real-Time Transaction Processing for Faster Checkouts

Real-Time Transaction Processing for Faster Checkouts

A reliable eCommerce payment integration should process transactions in real time. Instant approvals and confirmations ensure the payment flow remains smooth, avoiding delays that frustrate customers.

A slow payment gateway system leads to failed transactions and abandoned carts. Real-time processing keeps customers happy and revenue flowing.

Fraud Detection and Prevention for Safe Transactions

Fraud Detection and Prevention for Safe Transactions

Integrate fraud detection systems into your payment gateway system to prevent suspicious activities. Features like transaction monitoring and AI-driven fraud alerts can protect your business and customers from fraud attempts.

Advanced fraud detection tools, powered by ai and machine learning solutions, reduce chargebacks, prevent unauthorized transactions, and ensure every payment is safe and verified.

Scalability to Handle Peak Traffic

Scalability to Handle Peak Traffic

During high-traffic events like Black Friday or holiday sales, your eCommerce payment gateway integration should be scalable to handle large transaction volumes without downtime or crashes.

Scalability ensures your payment system performs flawlessly under pressure, so you don’t miss sales opportunities during peak seasons.

Seamless Integration with Leading Platforms

Seamless Integration with Leading Platforms

Your payment gateways integration must work seamlessly with popular eCommerce platforms like Shopify, WooCommerce, Magento, or custom-built systems. This avoids compatibility issues and simplifies implementation.

Leveraging system integration services ensure your payment gateway fits smoothly into your existing eCommerce architecture without disruptions.

Analytics and Reporting for Actionable Insights

Analytics and Reporting for Actionable Insights

An advanced payment gateway system should provide insights into payment success rates, failed transactions, and refund trends. These analytics help you understand customer behavior and optimize payment processes.

Detailed reporting and analytics allow you to identify pain points, improve conversions, and enhance customer satisfaction.

Refund and Chargeback Management for Better Customer Service

Refund and Chargeback Management for Better Customer Service

Handling refunds and chargebacks manually can be time-consuming and error-prone. Your payment gateway integration should streamline this process, allowing easy management of refunds and dispute resolutions.

Simplified refund management ensures quick resolutions, enhancing customer satisfaction and building trust in your eCommerce brand.

A payment system that lacks these essential features can cost you conversions, trust, and long-term growth. Don’t let that happen—invest in a payment gateway system that’s built for today and ready for tomorrow.

Need More Exclusive Features for Your eCommerce Payment Integration System? Contact Us Today!

Payment Gateway Integration for eCommerce Site Step by Step

Integrating a payment gateway into your eCommerce store might sound technical, but understanding the process is essential to ensure a smooth, secure, and efficient checkout experience for your customers. Let’s start with the first two critical steps: choosing the right payment gateway system and setting up your merchant account.

Choose the Right Payment Gateway Provider

Choose the Right Payment Gateway Provider

Choosing the right eCommerce payment gateway provider is the foundation of a seamless integration process. The ideal gateway should be:

- Secure: Offers PCI-DSS compliance and robust encryption.

- Flexible: Supports multi-payment options, including credit cards, wallets, and BNPL.

- Global: Allows multi-currency transactions for cross-border sales.

- Scalable: Handles high transaction volumes without downtime.

Your eCommerce payment integration should align with your business size, audience needs, and technical requirements. Whether you’re using Shopify, WooCommerce, or a custom platform, ensure compatibility for smooth operation. Professional eCommerce integration services can help you evaluate options like PayPal, Stripe, Razorpay, and Square.

Set Up a Merchant Account

Set Up a Merchant Account

A merchant account is a critical element of your payment gateway integration in eCommerce. It acts as a bridge between your online store, the payment gateway provider, and your bank to securely process transactions. Without this setup, payments cannot be received and transferred to your business account.

Here’s a breakdown of the process:

- Choose the Right Merchant Account Provider: Work with a provider that supports your chosen eCommerce payment gateway integration and fits your business model. Banks, third-party providers, or integrated solutions (like Stripe or PayPal) offer different benefits.

- Submit Business Documents: To set up your merchant account, you’ll need your business registration details, proof of identity (for authorized personnel), bank account information, your eCommerce store’s URL and privacy policy.

Get Approval for Transactions

Get Approval for Transactions

The provider will assess your business to ensure compliance with payment security protocols. It’s essential to have a payment gateway system that supports PCI-DSS compliance to avoid delays.

Integrate Merchant Account with the Payment Gateway

Integrate Merchant Account with the Payment Gateway

Once approved, your eCommerce payment gateway must be integrated with your merchant account. At this stage, working with experts in technology consulting services or eCommerce software development can save time and prevent errors.

Test Transactions to Validate the Setup

Test Transactions to Validate the Setup

Perform sandbox testing to ensure real-time transaction processing, accuracy, and security of payments.

Setting up a merchant account can be overwhelming, but it’s the backbone of your payment gateway integration services. By following this step meticulously, you ensure your payment gateway operates efficiently, securely, and seamlessly across all transactions.

The Challenges of Payment Gateway Integration Without the Right Expertise

You’ve chosen a payment gateway provider, set up your merchant account, and now you’re ready to integrate. But without the right expertise, what seems like a straightforward process can quickly spiral into a maze of delays, errors, and frustrated customers. Here’s what can go wrong if you don’t approach eCommerce payment gateway integration the right way.

Delayed Integration Timelines

Integrating a payment gateway system is a highly technical process that involves API connections, sandbox testing, and performance optimization. Without the right expertise, businesses often experience delays due to incorrect configurations, untested features, or endless troubleshooting.

Delays in launching your eCommerce payment gateway mean lost revenue, stalled operations, and a poor first impression on your customers.

Security Loopholes That Put Customer Data at Risk

Payment security is non-negotiable. Without proper PCI-DSS compliance and encryption, even a minor misstep during payment gateway integration can expose sensitive customer data to fraud and breaches.

Insecure payment gateway integration in eCommerce risks legal penalties, damage to your reputation, and, most importantly, loss of customer trust.

Incompatibility with Existing Systems

Many eCommerce platforms rely on multiple tools—inventory management systems, CRMs, and third-party plugins. A poorly executed eCommerce payment integration can cause conflicts, resulting in failed transactions or system crashes.

If your payment gateway system isn’t seamlessly compatible with your existing eCommerce architecture, you risk operational disruptions and customer dissatisfaction.

Poor User Experience Leading to Cart Abandonment

Integration errors, slow transaction processing, or unoptimized mobile experiences can result in abandoned carts and frustrated users. Every additional second or unnecessary step in the checkout process increases the likelihood of lost sales.

In today’s competitive market, customers demand seamless, error-free checkouts. Anything less, and they’ll move to a competitor with a better eCommerce payment gateway integration.

The Solution: Partnering with Experts for Flawless Payment Gateway Integration

Integrating a payment gateway system and payment automation systems is more than just connecting APIs; it’s about creating a secure, seamless, and optimized experience that drives revenue and trust. Partnering with professionals ensures your eCommerce payment gateway integration is executed efficiently, securely, and without hidden pitfalls.

Partnering with professionals ensures your eCommerce payment gateway integration is done right—the first time. Secure, seamless, and optimized for growth.

That’s where Matellio comes in!

Get a Free 30-minute Consultation with Our Experts for eCommerce Payment Gateway Integration!

Why Choose Matellio for Your eCommerce Payment Gateway Integration?

Your payment gateway isn’t just a feature—it’s the core of your eCommerce success. To ensure your eCommerce payment gateway integration is flawless, secure, and built to scale, you need more than just a development team—you need a trusted technology partner. That’s where Matellio comes in.

Proven Expertise in eCommerce Integration Services

At Matellio, we bring years of experience delivering eCommerce payment integration solutions tailored to businesses of all sizes. From simple setups to complex integrations, we ensure your payment gateway in eCommerce is configured to perfection.

Our expertise spans popular platforms like Shopify, WooCommerce, Magento, and custom-built eCommerce solutions. When you choose Matellio, you’re choosing precision, experience, and reliability.

Advanced Technology Integration

At Matellio, we don’t just stop at basic integrations. We leverage cutting-edge tools, including to future-proof your payment gateway. Our advanced digital transformation consulting services incorporate AI for fraud detection, cloud solutions for scalability, and mobile-first designs to maximize conversions.

Secure and Compliant Payment Solutions

We prioritize your customers’ security with PCI-DSS compliant payment gateway systems and robust encryption protocols. By integrating fraud detection systems and end-to-end security, we help you build trust and prevent vulnerabilities.

Your customers deserve a safe and seamless checkout experience. With Matellio’s payment gateway integration services, every transaction is secure, reliable, and fraud-proof.

Customized Solutions for Global Businesses

One-size-fits-all doesn’t work in the eCommerce world. Our payment gateway integration in eCommerce is tailored to meet your unique business needs, ensuring multi-currency support, mobile optimization, and scalable solutions for global growth.

We deliver fully customized eCommerce payment gateway solutions that support multiple payment modes—credit cards, UPI, BNPL, wallets—and currencies, empowering your business to expand globally.

End-to-End Integration Services

We provide payment gateway integration for eCommerce sites step by step, handling everything from API integration and sandbox testing to performance optimization and final deployment.

Our team ensures every technical detail is perfect, so your payment gateway system runs smoothly from day one. From setup to scaling, we’ve got you covered.

Agile Development with Faster Timelines

Time is money in the eCommerce industry. Our eCommerce software development follows Agile methodologies to ensure rapid deployment, transparency, and flexibility. With Matellio’s streamlined development process, we deliver fast, accurate, and error-free payment gateway development so you can start capturing revenue sooner.

Unmatched Support and Post-Integration Maintenance

A successful eCommerce payment integration doesn’t end at launch. Our team provides ongoing support, updates, and performance monitoring to keep your payment systems running flawlessly. From fixing glitches to scaling your system during peak traffic, our consulting services ensure you never face downtime or missed opportunities.

Transparent Communication and Collaboration

At Matellio, we believe in complete transparency and collaboration throughout the project. You’ll receive regular updates, clear timelines, and dedicated support to ensure the integration aligns with your business goals. With our business consulting services, we guide you through every step, ensuring your eCommerce payment gateway integration delivers maximum ROI.

At Matellio, we combine expertise, advanced technology, and a client-centric approach to deliver unmatched payment gateway integration services. Whether you need a secure eCommerce payment gateway, scalable systems, or seamless global transactions, we ensure your integration drives growth, trust, and revenue. With Matellio, you don’t just get an integration—you get a strategic partner invested in your success.

Ready to build a payment gateway that converts? Schedule a free 30-minute consultation to get started today!

eCommerce Payment Gateway Integration – FAQ’s:

Q1. How long does it take to integrate a payment gateway into my eCommerce store?

The timeline depends on your platform and complexity but typically ranges from 1-4 weeks for seamless payment gateway integration services.

Q2. Can the payment gateway handle international transactions and multi-currencies?

Yes, with proper eCommerce payment gateway integration, the system can process multiple currencies, enabling global reach.

Q3. What security measures are implemented to protect customer data?

We ensure PCI-DSS compliance, end-to-end encryption, and advanced fraud detection systems to secure all transactions.

Q4. Will the payment gateway work across all devices, including mobile platforms?

Absolutely. A mobile-optimized eCommerce payment integration ensures a seamless experience on all devices.

Q5. What happens if there are technical issues after the integration is complete?

We provide ongoing support, monitoring, and troubleshooting to ensure your payment gateway system operates smoothly at all times.

PCI-DSS Compliance for Maximum Security

PCI-DSS Compliance for Maximum Security Multi-Payment Options to Cater to Every Customer

Multi-Payment Options to Cater to Every Customer Mobile Optimization for Seamless Payments

Mobile Optimization for Seamless Payments Multi-Currency Support for Global Expansion

Multi-Currency Support for Global Expansion Real-Time Transaction Processing for Faster Checkouts

Real-Time Transaction Processing for Faster Checkouts Fraud Detection and Prevention for Safe Transactions

Fraud Detection and Prevention for Safe Transactions Scalability to Handle Peak Traffic

Scalability to Handle Peak Traffic Seamless Integration with Leading Platforms

Seamless Integration with Leading Platforms Analytics and Reporting for Actionable Insights

Analytics and Reporting for Actionable Insights Refund and Chargeback Management for Better Customer Service

Refund and Chargeback Management for Better Customer Service Choose the Right Payment Gateway Provider

Choose the Right Payment Gateway Provider Set Up a Merchant Account

Set Up a Merchant Account Get Approval for Transactions

Get Approval for Transactions Integrate Merchant Account with the Payment Gateway

Integrate Merchant Account with the Payment Gateway Test Transactions to Validate the Setup

Test Transactions to Validate the Setup