Thinking of building a personal expense management app like My Income?

Around 1.8 billion people of today’s generation are among the age group that needs the most help with their personal finance management. With such a huge target audience, it is definitely a lucrative idea to invest in an app that they are definitely going to use. However, you’re not the only fortune seeker. Market is flooded with personal expense tracker apps, and some of them are actually doing pretty well.

One of such apps, which despite its neophyte state has managed to acquire a huge target user base, is My Income. Launched quite recently, the app is already enjoying quite a popularity among people. The multi-functional app, at the time of writing this post, is offering its services for free. However, you can build on its original idea to open up new revenue streams for your business. But before we go any deeper, let’s have a quick overview of the app itself.

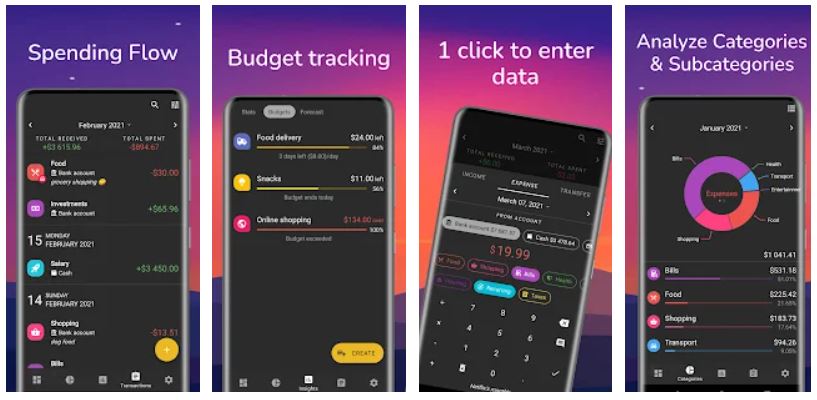

About My Income App

Image Source

My Income is an incredibly easy-to-use personal finance management app that allows you to visualize your budget, income, and expenses all at the same place. The app can keep records of the myriad of your transactions and draw meaningful insights from them. Some of the other functionalities of the app include –

- Multiple Bank Account Balance Management

- Credit Card Management

- Investments Overview

- Money Flow Visualization

- Neat Interface with Dark Mode Option

- Data Security

- Transaction Navigation

- User Account Authentication

- Track ROI

- Manage Regular Expenses

- Data Export

- Detail Analysis Charts.

With so many rich features, the app has won the hearts and minds of the users who were actively looking for a free or cost-effective solution to manage their finances better. There are still many more people looking for similar or more valuable solutions, and following a clear-to-follow approach, you can very well build that app yourself.

Steps To Develop a Personal Expense Management App Like My Income

Now since you have a clearer picture of the My Income app, let’s see all the steps you need to take to make its clone app.

Meet The Major Players

You know t major competition, and the inspiration for your expense tracker app is My Income. However, it is far from the only player in the market. If you want your app to stand out from the competition, it is s important to learn not just the one app but others too. So that you can combine and offer more value through your app, making it more valuable for the target audience. Some of the other popular apps you can study for this purpose are –

- Mint

- Quickbooks

- YNAB

- Good Budget

- Spending Tracker

These are some of the more popular players in the market, and your app will definitely do better by including its pros and cons in the planning stage.

Determine Your Monetization Strategy

Making an app a profitable investment requires research. You need to understand how much your app can help its target users, and what reasonable amount they will be willing to pay for it. Other than that, you will also have to understand the market niche of your app to keep a competitive edge over your monetization strategy. This being said, there are majorly four ways you can monetize your personal expense tracker app like My Income.

Paid App

If your app is solving crucial problems for your users, the best and simplest way to make money through it is by launching your app as a paid one. Now, My Income is a free app. Therefore, if you want your app to earn money through installation price, you need to ensure that it is either offering something more valuable to the users or is marketed better to make its purchasing prices seem justifiable.

In-App Purchases

You can offer paid cross-services on your app. For example, you can gamify your app by allowing users to use the app through a virtual in-app currency. New users can be given a certain initial amount of this and then allotted a certain amount regularly. In case a user wants to use the app more times, they can purchase the currency with a real one through in-app purchases.

Advertisements

For free apps, advertisements are the best means to earn regular income. Over 96% of apps on the Play Store are available for free download. A substantial number of these apps rely on in-app advertisements for monetization. You can do that too to penetrate the market and attract more audience through the free installation.

Premium Services

Another interesting way to monetize a personal expense tracker app is by offering premium services. Since you know your users are installing the app to simplify their budget management. Suppose you can further simplify it by leveraging automation and bank account integration. In that case, you can ensure that you are targeting your audience pretty well with free services and retaining the paying ones through such premium services.

Using any of these monetization methods, you can start earning through your app pretty fast. However, you cannot choose a monetization method unless you know which features can be monetized. So, let’s learn more about the different features your app can offer.

Identify The Functionalities to Develop

Everyone wants an app that can do everything possible. However, this isn’t a practical approach when developing a personal expense management app. Doing so can easily make your user experience unnecessarily complicated, defeating the purpose of making it easy for users to manage their finances. Therefore, just look at what functionalities a user would expect from an app like My Income, and then maybe add some more that can enhance their experience. Some of the main features you can include in your list are –

User Profile Management

For an app to function on a personal level, adequate functionalities must be provided to manage the user accounts. Your app must have a user registration and authentication panel so that they can use the app on as many devices as they want. Users should also be allowed an easier way to log in or register an account on the app through social media channels. Almost all the apps allow users to log in through their Gmail or Facebook accounts. You can facilitate this, too, with simple APIs.

Income Accounts Management

Allow your users to aggregate all their income accounts, so they do not have to tally it over and again to see their overall financial status after every transaction. Users should be able to add multiple accounts and their respective balances. This way whenever an expense occur, they can simply add that among expense, and you will have the final balance calculated, regardless of which account the expense has been made.

Visualization

A personal expense app without proper visualization is rather useless. Remember the purpose of the app is to simplify financial management for users. If the app is only showing amounts in a ledger perhaps, it isn’t making anything easy for the user. Instead, proper graphs, pie charts, etc., should be used to let the user know where their most expenses are happening and what they can do to improve the situation.

Personalized Tips

After some time, when a user has made sufficient entries in their account, they should be able to use that data to gather personalized tips. For example, suppose a user has been spending too much money on ad-hoc medicines. In that case, the app can suggest ideas to make the person lead a healthier life, even if that includes additional expenses like the gym or a more nutritional diet. Such tips can make the app more engaging and useful.

Tracking Recurring Expenses

Allowing users to add their monthly, yearly, or other regular expenses can help them manage their income more wisely. The app can help give better-personalized tips if it knows what fixed regular expenses the user has. For this feature to function seamlessly, you can even allow users to integrate the payment of their bills with the app so that it can get updated as soon as a user has paid the bill, not requiring them to make the entry for it separately.

Document The Requirements

After creating a concrete image for all the features you want your app to have, the immediate following action is to evaluate their feasibility. If some of the features could not be developed due to some of the other constraints, you’ll have to drop them before you can begin the actual development process. Once that’s done, you are now ready to document all your requirements upon which you can hire skilled resources to develop your My Income-like app. While creating this document, make sure you also add details about the target audience and the platform they are supposed to use your app on. You would also like to document the basic UI of your app so that you have a clearer image of your app by the end of this step.

Prioritize The Features for Your MVP

MVP or Minimum Viable Product is the deployable prototype of any app. It is widely accepted that instead of waiting for all your app features to get developed, one should focus on first creating and deploying a prototype or MVP that can be launched and tested early in the development process. Doing so helps in two ways. First, you will be able to launch your app in the market well ahead of time, giving you an edge over the competition. Second, you will get to know what other features are more important to the users, so you can instead focus on them for the next version’s development. So, once you have decided all the features you would want your expense management app to have, it’s time for you to decide what core features you can deploy the fastest while ensuring that the app is usefully functional.

Hire a Mobile App Development Company

Once you have a clear image of what functionalities you want to offer through your app, it’s time for you to look out for a reliable mobile app development company. You can also suffice it by hiring a developer. However, it is suggestible to do so only if you have an excellent grasp of all your tech requirements and have the time to monitor the app’s progress. In most cases, it’s ideal to hire a company to formulate you a team of –

[/vc_column_text][/vc_column][/vc_row]

Maintenance and Improve

After deploying a version of your app, you need to measure its performance on various metrics. How much time are users spending on it? What issues are they facing with the key features, and what more features are they looking for? You can gauge all this information through in-built behavioral analytics and by creating incentivizing surveys for the purpose. The idea is to keep improving your expense management app until it becomes the go-to solution for your target audience.

Wrapping Up

We saw how complex it could get to build a personal expense management app like My Income without reliable aid. Eventually, the quality of your app and its overall experience can be only as good as the developers’ skillsets. This is why when it comes to developing a financial management app, we at Matellio only assign the subject matter experts to develop the project.

With over two decades of experience in creating a bespoke app in the finance industry vertical, we know all the crucial factors associated with tech solutions in the field. Our highly skilled developers work in a way that ascertains both compliance with the related laws and the best-in-class UX while deploying your project as soon as possible.

This is why we think that if you’re planning to build a similar app like My Income, Matellio can prove to be an exceptional partner to you. So don’t fret even if you’re just conceptualizing the idea. Simply fill this form to get a free quote and consultation from our experts and set things in motion when the market is still lucrative and receptive to new ideas.