Picture this: your competitors are closing loans in minutes while your team is buried under piles of paperwork, struggling with outdated systems, and losing customers to faster, smarter lenders. The truth is, the game has changed, and without cloud lending solutions, you’re not just falling behind—you’re risking your future.

Imagine having a SaaS lending platform that streamlines your operations, eliminates inefficiencies, and ensures every loan is processed faster, smarter, and without errors. Developing custom loan management software doesn’t just manage your loans but transforms them into an engine for growth. Now, ask yourself: can you afford to stay where you are?

At Matellio, we don’t just build cloud-based loan management software; we build solutions that solve the most pressing challenges in banking today. From skyrocketing customer expectations to the complexities of compliance, we design digital lending platforms to meet the needs of modern finance leaders like you—leaders who know that sticking to the old ways is no longer an option.

This is your chance to embrace innovation, outperform competitors, and future-proof your business. Read our blog till the end to discover the best features, tech stack, and a step-by-step process for cloud-based loan management software development.

What Are Cloud Lending Solutions and How Do They Solve Traditional Lending Problems?

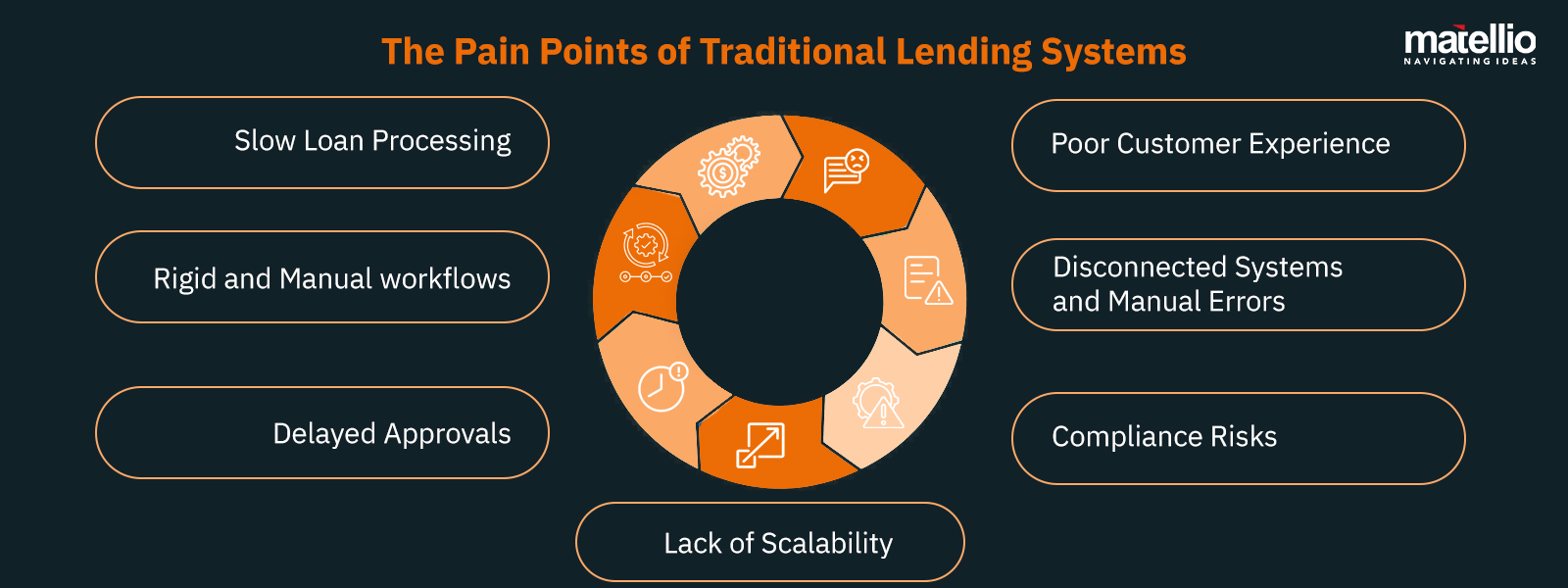

Let’s face it: traditional loan management systems are riddled with inefficiencies that directly impact on your bottom line.

That’s exactly where cloud-based loan management software comes into play! But what exactly are these cloud lending solutions?

In today’s fast-paced financial landscape, cloud lending solutions are not just an upgrade—they’re a revolution. These innovative platforms harness the power of cloud integration services to streamline loan origination, management, and servicing processes.

Unlike traditional, siloed systems that often cripple efficiency and scalability, cloud-based loan management software offers a unified, agile, and intelligent approach to lending. Here’s how:

Accelerated Loan Approvals with SaaS Lending Platforms

By leveraging a SaaS lending platform, you can automate repetitive tasks, reduce approval times, and eliminate bottlenecks. Borrowers get faster decisions, and you get happier customers.

Scalability and Flexibility with Cloud-Based Solutions

A cloud-based loan origination system grows with your business, ensuring that you can scale effortlessly to meet market demands. Whether you’re managing a few dozen or thousands of loans, the system adapts to your needs.

Compliance Made Easy with Advanced Loan Management Software

Regulations are constantly evolving, but cloud loan management software keeps you ahead of the curve. Integrated compliance tools, powered by AI integration services, ensure accurate reporting and adherence to standards, mitigating risks.

Enhanced Customer Experience through Digital Transformation

By implementing a digital lending platform, you deliver a seamless, end-to-end customer journey. Borrowers can apply, track, and close loans effortlessly, giving you a competitive edge in an increasingly customer-driven market.

In short, with cloud lending solutions, you gain the tools to outpace competitors, enhance operational efficiency, and drive revenue growth. This is not just an investment; it’s a transformation. And in today’s financial world, transformation is survival.

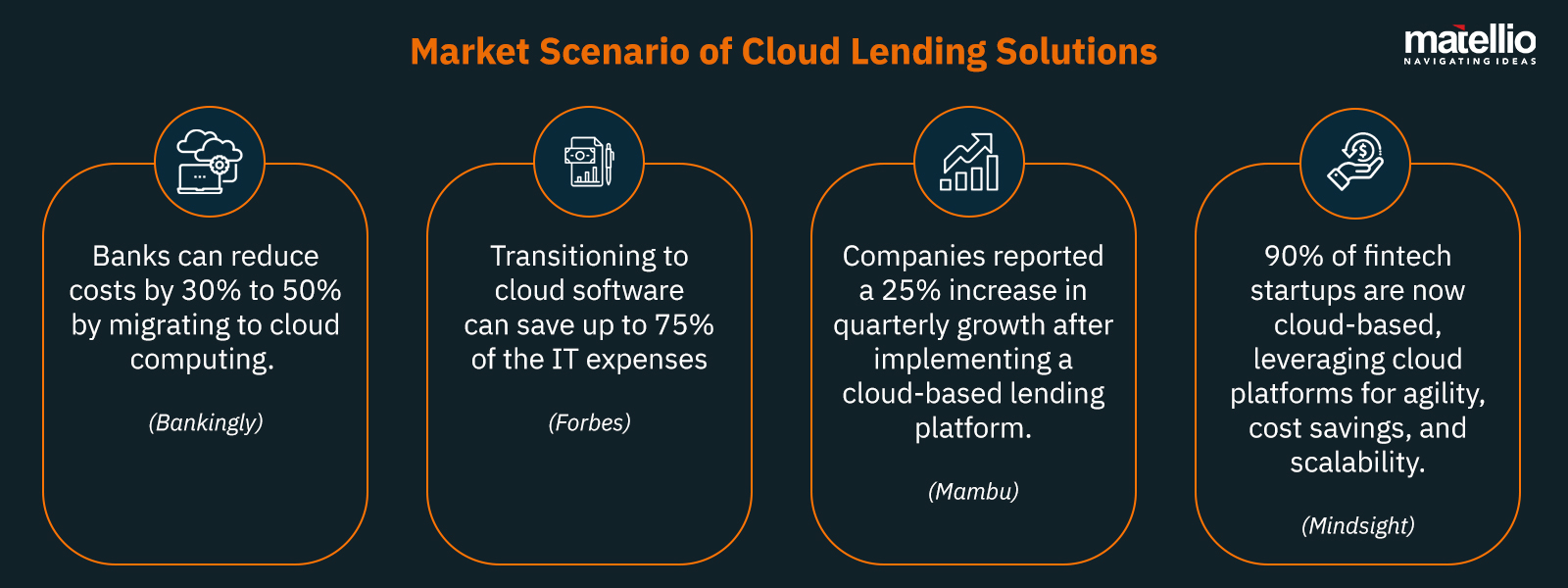

Why You Can’t Afford to Wait: The Urgency of Adopting Cloud Lending Solutions

The financial landscape is evolving faster than ever, and the adoption of cloud lending solutions is no longer a “nice-to-have”—it’s a necessity. Well, that’s what the market stats reveal!

According to a trusted source, the global digital lending platform market is projected to grow from approximately USD 7.06 billion in 2023 to USD 26.27 billion by 2032, growing at a compound annual growth rate (CAGR) of 15.5%.

With market trends indicating explosive growth in digital lending, businesses leveraging SaaS lending platforms and advanced cloud-based loan management software are reaping substantial rewards. If you’re not acting now, you’re already falling behind.

Accelerated Loan Processing

Accelerated Loan Processing

Tired of losing deals to faster competitors? A SaaS lending platform automates workflows, slashing loan approval times from weeks to mere hours. Faster loans mean happier customers and a reputation as an industry leader. With Matellio’s SaaS development services, speed is no longer a challenge—it’s your superpower.

Enhanced Security and Compliance

Enhanced Security and Compliance

Your borrowers trust you with their most sensitive data. Don’t let them down. Cloud-based loan origination systems ensure airtight security with encryption, real-time monitoring, and compliance updates. Protect your business, satisfy regulators, and sleep easy knowing your system is rock-solid. With cloud computing, security is built right in.

Cost Efficiency

Cost Efficiency

Why waste money on outdated infrastructure? Cloud loan management software eliminates high costs with a flexible, pay-as-you-go model. Redirect resources to growth and innovation, not maintenance.

Scalability and Flexibility

Scalability and Flexibility

Can your current system handle growth? Cloud-based loan management software scales with you, effortlessly adapting to market demands. From a surge in loans to expanding operations, you’ll always be ready.

Improved Customer Experience

Improved Customer Experience

Today’s borrowers demand speed, simplicity, and transparency. A digital lending platform delivers all three with intuitive interfaces, instant updates, and personalized service. Build loyalty, enhance satisfaction, and stand out in a competitive market. Add AI chatbot development services to make every customer interaction extraordinary.

All in all, adopting cloud lending solutions isn’t just an upgrade—it’s the key to dominating the financial industry. With Matellio, you get the tools and expertise to lead the market, not follow it. It’s time to act.

Ready to Develop Cloud Lending Solutions? Begin with a Free 30-minute Consultation!

Features You Can’t Ignore When Developing Cloud Lending Solutions

Now that you’ve decided to embrace cloud lending solutions, it’s time to focus on what really matters—the features that will set your software apart and ensure unparalleled performance.

As a leading digital transformation services company, we’ve hand-picked the most crucial features your cloud-based loan management software must have, along with some advanced capabilities to give you a competitive edge.

Automated Loan Origination

Streamline your loan approval process with an automated cloud-based loan origination system. This feature reduces manual intervention, minimizes errors, and accelerates approvals. By leveraging our AWS data migration services, you can enjoy seamless connectivity across platforms, delivering faster decisions to your borrowers.

Comprehensive Borrower Management

Track, manage, and engage with borrowers efficiently. This feature consolidates borrower information, making it accessible and actionable in real-time. Enhanced data visibility enables personalized experiences and builds trust. With banking analytics solutions, you can analyze borrower trends for better decision-making.

Integrated Compliance Tools

Regulatory landscapes are constantly shifting, and manual compliance is a nightmare. Ensure adherence with built-in compliance tools that keep your processes up-to-date. Our expertise in SaaS development ensures your system remains compliant with zero additional effort.

Dynamic Loan Repayment Scheduling

Offer borrowers flexibility with customizable repayment schedules. Whether fixed-term or dynamic, this feature ensures that repayment plans align with your borrowers’ financial needs, improving retention and satisfaction.

Robust Reporting and Analytics

Get actionable insights with advanced data analytics capabilities. This feature tracks KPIs, identifies bottlenecks, and improves decision-making. With AI, you can further enhance these analytics for predictive modeling and risk assessment.

Role-Based Access Control (RBAC)

Maintain security and data integrity by granting access based on user roles. This ensures sensitive information is only accessible to authorized personnel, reducing the risk of breaches.

AI-Powered Risk Assessment

Go beyond basic credit checks with AI-driven risk models that predict loan default probabilities. This feature, powered by our ML model development services, enables precise decision-making, reducing non-performing assets (NPAs).

AI Chatbots for Borrower Assistance

Provide 24/7 support with AI chatbots that assist borrowers in completing applications, checking statuses, and resolving queries, all without human intervention. This reduces operational costs while enhancing the borrower’s experience.

Robotic Process Automation (RPA) for Underwriting

Automate tedious underwriting tasks using RPA use cases in banking, streamlining workflows and significantly reducing processing times. With Matellio’s expertise in RPA, this feature ensures efficiency and precision.

Hyper-Personalization with Predictive Analytics

Offer borrowers tailored loan products based on predictive analytics. This advanced feature uses borrower data to recommend loan packages, improving cross-selling opportunities and customer loyalty.

Seamless Legacy System Integration

Transition smoothly with features that allow data migration from legacy systems into your cloud loan management software without disruption. This ensures continuity while upgrading to cutting-edge solutions.

By incorporating these essential and advanced features, your cloud-based loan management software won’t just meet industry standards—it will set new ones.

Top Tech Trends that Can Elevate the Capabilities of Your Cloud Lending Solution

Well, choosing the right mix of features is okay. But what if we tell you that you can elevate the capabilities of your by incorporating the next-gen technologies in your software? Yes, you heard it right!

Choosing the best technologies will not only help you survive today btu will even make your investment future-ready. However, choosing the latest yet reliable technology trends can be daunting, especially if you are new to the software development field. But not for us!

As your trusted fintech software development company, we have hand-picked the best tech trends that can seamlessly enhance your loan lending system’s capabilities:

| Technology | Value Added |

| Banking Analytics | Improves risk assessment, enables personalization, identifies trends, reduces NPAs. |

| Robotic Process Automation (RPA) | Automates tasks, speeds up workflows, reduces errors, boosts productivity. |

| Machine Learning (ML) | Predicts defaults, enhances fraud detection, improves targeting, optimizes repayment. |

| Edge Computing | Real-time processing, enhances borrower interactions, optimizes performance, reduces costs. |

| AI and Chatbots | Improves engagement, cuts costs, streamlines processes, personalizes communication. |

Banking Analytics

Banking Analytics

Banking analytics unlocks the full potential of your borrower and loan data. By analyzing large datasets in real-time, this technology identifies trends, predicts risks, and personalizes offerings, enabling smarter decision-making. It’s no longer just about data collection—it’s about using that data to create actionable insights that drive success. With analytics in the banking industry, you gain a competitive edge in customer retention and risk mitigation.

- Improves risk assessment accuracy.

- Enables personalized loan products and offerings.

- Identifies trends for proactive decision-making.

- Reduces non-performing assets (NPAs).

Robotic Process Automation (RPA)

Robotic Process Automation (RPA)

RPA automates repetitive tasks in loan processing, such as document verification, underwriting, and compliance checks. This reduces errors, accelerates approvals, and allows your team to focus on higher-value activities. Leveraging RPA services, you can increase efficiency and lower operational costs while delivering faster service.

- Automates loan application processing.

- Speeds up underwriting and compliance workflows.

- Reduces manual errors significantly.

- Enhances team productivity.

Machine Learning (ML)

Machine Learning (ML)

Machine Learning introduces predictive analytics and advanced risk modeling to your lending operations. By analyzing borrower behavior, credit history, and market conditions, ML algorithms provide accurate insights for loan approvals and collections. With machine learning solutions, you minimize defaults while maximizing profitability.

- Predicts loan default probabilities.

- Enhances fraud detection and prevention.

- Improves customer segmentation and targeting.

- Optimizes loan repayment strategies.

Edge Computing

Edge Computing

Edge computing processes data closer to the source, reducing latency and enhancing real-time decision-making. For cloud-based loan origination systems, this means faster approvals and seamless borrower interactions, even in low-bandwidth environments. It’s a game-changer for institutions looking to operate at lightning speed.

- Enables real-time loan application processing.

- Enhances borrower interactions with reduced delays.

- Optimizes performance in remote or low-connectivity areas.

- Reduces server dependency and bandwidth costs.

Artificial Intelligence (AI) and Chatbots

Artificial Intelligence (AI) and Chatbots

AI-powered systems and chatbots redefine customer service by providing instant, accurate responses to borrower queries. Integrated into your digital lending platform, AI enhances operational efficiency and borrower satisfaction. With AI chatbots, powered by NLP services, your platform delivers 24/7 assistance with human-like interactions.

- Improves borrower engagement with instant support.

- Reduces operational costs through automation.

- Streamlines loan application and approval processes.

- Personalize borrower communication and recommendations.

Identify and Implement the Best Next-Gen Technology in Your Lending Solution. Contact Our Experts!

How to Develop Cloud-based Loan Management Software in 5 Easy Steps

Congratulations! You are now at the most awaited section of the blog post – developing cloud lending solutions. So, by now you may have explored everything related to the software development process – the features, tech stack, next-gen trends, etc. But how to combine all those and develop a functional solution? Well, don’t worry, as experts in digital transformation services, we have got this one covered!

Developing cloud-based loan management software can feel like a daunting task, but with a clear roadmap and strategic approach, it becomes a transformative journey. Here’s a detailed guide to help you build a robust, scalable, and efficient solution tailored to your needs.

Define Objectives and Analyze Requirements

Define Objectives and Analyze Requirements

Before diving into development, it’s crucial to define the purpose of your software and the problems it will solve.

Ask yourself these key questions:

- What are the pain points in your current loan management systems?

- What features are must-haves (like automated workflows, compliance tools) versus nice-to-haves (like advanced banking analytics solutions)?

- Who are your target users—borrowers, internal teams, or both?

- How will the software integrate with existing systems?

This step is where you finalize the features, including essentials like digital lending platforms and unique functionalities like AI chatbot development services. Also, decide on the scalability requirements, as a SaaS lending platform thrives on flexibility.

Choose a Trusted Partner and the Right Tech Stack

Choose a Trusted Partner and the Right Tech Stack

Choosing a trusted company having expertise in enterprise software development services is of utmost importance. You need to select a partner having expertise in delivering end-to-end services ranging from consultation and strategy creation to software development and deployment.

Furthermore, the technology stack and architecture form the backbone of your cloud lending solutions. Opt for tools and frameworks that ensure scalability, security, and flexibility.

Recommended Tech Stack:

- Backend: Node.js, Python, or Java for scalability.

- Frontend: Angular, React, or Vue.js for a seamless UI/UX.

- Database: PostgreSQL or MongoDB for robust data handling.

- Cloud Services: AWS, Microsoft Azure, or Google Cloud for hosting.

- Integrations: Plaid API, Stripe API, Experian API, AWS API Gateway, Google Maps API

- Data Analytics: Chart.js, Tableau, Power BI, OpenAI (predictive analytics)

- DevOps: Docker, Kubernetes, Jenkins, Ansible

Also, choose a microservices architecture for easier updates and scalability. With cloud services, you can ensure seamless communication between all components.

Read More: Discover how a cloud staffing agency streamlines talent acquisition and enhances workforce flexibility in the digital era.

Adopt Agile Development and Build an MVP

Adopt Agile Development and Build an MVP

Agile development ensures flexibility and continuous improvement throughout the software creation process. Start with an MVP (Minimum Viable Product) to test the core functionality with minimal resources.

Why Agile and MVP Are Crucial:

- Agile allows iterative development, enabling you to adapt to changing requirements quickly.

- MVP development helps you test core features—such as cloud-based loan origination systems—with real users and gather feedback.

For example, launch your software with critical features like loan application management, repayment scheduling, and compliance tools, and then enhance it with advanced features like RPA use cases in banking and predictive analytics.

Prioritize Testing and Security

Prioritize Testing and Security

Software testing services are non-negotiable when it comes to cloud loan management software. Given the sensitive nature of financial data, rigorous testing ensures security, reliability, and performance.

Key Testing Methods:

- Functional Testing: Ensure all features work as expected, from loan processing to compliance checks.

- Load Testing: Test scalability by simulating high traffic and large volumes of transactions.

- Security Testing: Use tools like OWASP ZAP to identify vulnerabilities and ensure encryption for data protection.

Additionally, implement role-based access control (RBAC) to restrict data access, enhancing both security and compliance.

Deploy, Monitor, and Upgrade Regularly

Deploy, Monitor, and Upgrade Regularly

Once your cloud-based loan management software is developed and tested, it’s time to deploy it. However, the work doesn’t end there—ongoing monitoring and regular upgrades are critical to maintaining performance and relevance.

Post-Deployment Checklist:

- Use tools like Prometheus or Nagios for monitoring software performance.

- Collect user feedback to identify areas for improvement.

- Plan regular updates to incorporate trends like ML model development services, edge computing, and advanced analytics.

Also, migrate data from legacy systems if you’re transitioning from older software, ensuring continuity without disrupting operations.

By following these steps, you’ll not only build an efficient cloud-based loan management software but also create a future-proof solution that drives growth, improves operations, and enhances borrower satisfaction. However, partnering with a trusted company ensures that you get the support required to make this process a piece of cake.

That’s where Matellio Comes In!

When it comes to building cloud-based loan management software, you need a partner who not only understands technology but also the intricacies of the financial industry. At Matellio, we bring unmatched expertise, cutting-edge innovations, and a deep commitment to delivering transformative results. Here’s why partnering with us is the smartest decision for your business:

Tailor-Made Solutions for Unmatched Scalability

We specialize in designing cloud lending solutions that are completely tailored to your unique business needs. Whether you need a robust cloud-based loan origination system or a fully integrated digital lending platform, our team ensures your solution is scalable to meet future demands without disruption.

Expertise in Next-Gen Technologies

At Matellio, we don’t just follow trends—we set them. From implementing ML model development services for predictive analytics to RPA for automating repetitive tasks, we ensure your software is future-ready.

Proven Track Record in the Financial Industry

With years of experience in software product development services, Matellio has a deep understanding of the financial sector. Our expertise ensures your software meets regulatory standards, enhances customer satisfaction, and delivers measurable ROI.

Agile Development Process with Rapid Delivery

Time-to-market is critical in the financial industry, and our Agile methodology ensures your cloud loan management software is delivered quickly without compromising quality. We also specialize in MVP development strategies to help you launch fast and scale seamlessly.

Holistic Approach to Security and Compliance

Security and compliance are non-negotiable in financial software. Our solutions are built with best-in-class AI development services and industry-standard protocols to safeguard your data and ensure full regulatory compliance.

Comprehensive Post-Deployment Support and Upgrades

We don’t just build software—we’re here to help it grow with you. From proactive monitoring to adding new features like AI chatbot development services or enhanced banking analytics solutions, our support ensures your system remains cutting-edge.

With our expertise in cloud integration services, digital transformation services, and a proven track record in delivering high-impact cloud lending solutions, Matellio is the ideal choice for financial institutions seeking innovation and growth. Let’s redefine lending—together. Schedule a free 30-minute consultation to get started today!

Cloud Lending Solutions Development – FAQ:

Q1. How long does it take to develop cloud-based loan management software?

Development timelines vary based on features, but with an Agile approach and an MVP model, a functional solution can be ready in 4-6 months.

Q2. Can this software integrate with my existing systems?

Yes, seamless integration with legacy systems and third-party tools is achievable through APIs and data migration from legacy systems.

Q3. How can I ensure the security of borrower data?

We implement advanced encryption, role-based access controls, and compliance protocols to safeguard sensitive data and meet regulatory standards.

Q4. What if my business needs to evolve over time?

Our solutions are built to scale, with flexible architecture and regular updates to accommodate changing business needs and new trends.

Q5. Is cloud software suitable for smaller financial institutions?

Absolutely! Cloud solutions are cost-efficient and scalable, making them ideal for financial businesses of all sizes, including smaller firms.

Accelerated Loan Processing

Accelerated Loan Processing Enhanced Security and Compliance

Enhanced Security and Compliance Cost Efficiency

Cost Efficiency Scalability and Flexibility

Scalability and Flexibility Improved Customer Experience

Improved Customer Experience Banking Analytics

Banking Analytics Robotic Process Automation (RPA)

Robotic Process Automation (RPA) Machine Learning (ML)

Machine Learning (ML) Edge Computing

Edge Computing Artificial Intelligence (AI) and Chatbots

Artificial Intelligence (AI) and Chatbots Define Objectives and Analyze Requirements

Define Objectives and Analyze Requirements Choose a Trusted Partner and the Right Tech Stack

Choose a Trusted Partner and the Right Tech Stack Adopt Agile Development and Build an MVP

Adopt Agile Development and Build an MVP Prioritize Testing and Security

Prioritize Testing and Security Deploy, Monitor, and Upgrade Regularly

Deploy, Monitor, and Upgrade Regularly