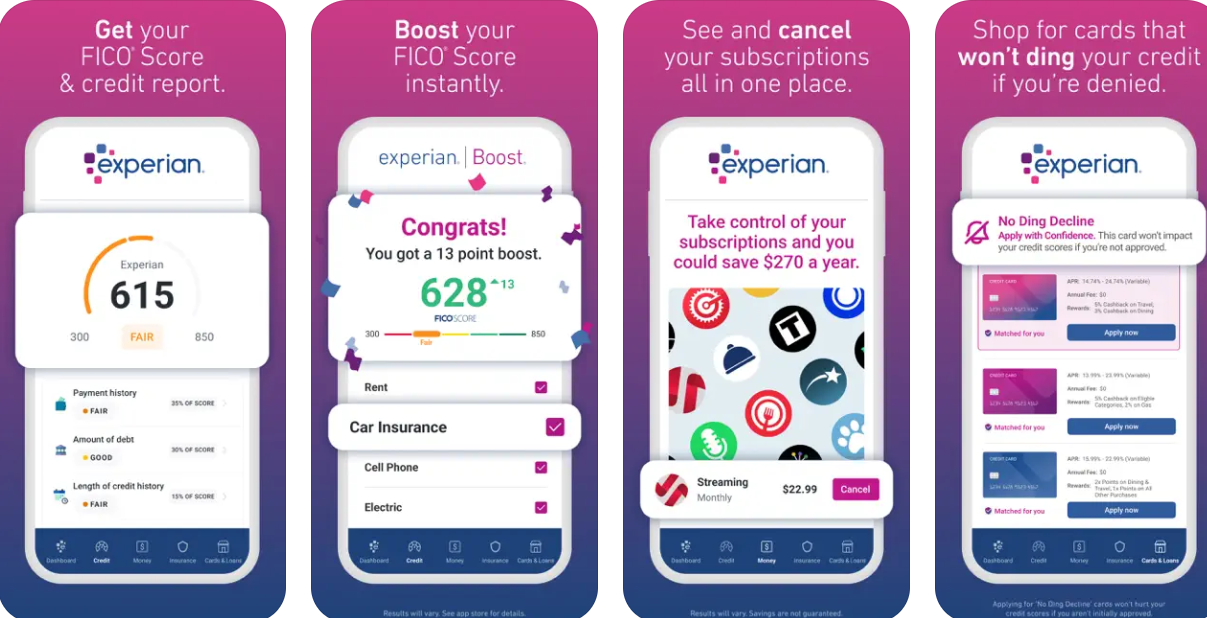

In today’s dynamic digital landscape, managing personal finances has become an integral part of everyday life. The increasing complexity of financial ecosystems has created a growing demand for advanced tools that simplify budgeting, credit monitoring, and financial planning. Apps like Experian have revolutionized personal finance management by providing individuals with accessible, user-friendly solutions to take control of their financial health.

As more users prioritize efficient and intuitive tools, the popularity of personal finance and credit management apps continues to rise. This trend presents a lucrative opportunity for businesses to develop financial planning app like Experian, enabling them to meet the evolving needs of tech-savvy users while establishing a strong foothold in the competitive fintech market. Beyond technical development, these apps empower users with smarter financial tools, fostering trust and long-term engagement with your brand.

What Is a Financial Planning App?

A financial planning app is a digital platform designed to help users manage their financial activities, such as budgeting, credit score tracking, debt management, and goal setting. These apps provide actionable insights through analytics and automation, enabling users to make informed financial decisions.

- Purpose: To simplify complex financial tasks and provide clarity in managing personal or business finances.

- Benefits: Users can track expenses, improve credit health, and set achievable savings goals with ease.

- Market Trends: The fintech sector is witnessing exponential growth, with users expecting real-time insights, seamless integrations, and secure platforms in financial planning apps.

Source: Experian

Why Invest in Developing a Financial Planning App Like Experian?

The demand for financial planning apps has seen exponential growth as individuals increasingly rely on digital tools to manage their personal finances. Here’s why investing in a personal finance management app like Experian is a strategic move for businesses looking to thrive in the fintech space:

Massive Market Potential

The fintech industry is at the forefront of technological advancement, with financial planning apps becoming an essential part of users’ daily lives. With users seeking accessible, efficient, and secure apps to manage personal finances, the market is ripe for innovation.

- By creating a solution that addresses users’ financial pain points, you can carve out a substantial market share in the rapidly growing fintech sector.

- Developing a finance mobile app development project positions your business to tap into a diverse and expanding audience, increasing both reach and revenue.

Recurring Revenue Models

Financial planning apps offer multiple monetization opportunities, such as subscription plans, premium features, and in-app purchases.

- By offering tiered pricing, users can choose between basic and premium memberships, which could include advanced tools like detailed analytics, credit score tracking, or exclusive savings calculators.

- Monetizing your financial app development through recurring revenue models ensures consistent income while providing users with value-added features that enhance their financial planning experience.

Brand Credibility

Launching a money management application with a focus on reliability, security, and innovation builds trust with users, positioning your brand as a leader in the fintech industry.

- A well-designed app demonstrates your commitment to solving real-world financial problems and strengthening customer loyalty and retention.

- Enhanced credibility leads to better user retention and word-of-mouth referrals, establishing your app as a trusted financial management application in the market.

Customer Engagement

Financial planning apps enable continuous engagement through personalized recommendations, goal tracking, and notifications. Users appreciate tools that not only simplify financial management but also keep them informed about opportunities to improve their financial health.

- Features like interactive dashboards and AI-driven insights keep users engaged while ensuring the app remains a valuable resource for their personal finance application needs.

- Long-term engagement fosters user loyalty, enabling upselling opportunities for premium services and strengthening your position in the fintech ecosystem.

Innovation Opportunities

Building an app like Experian provides a platform to integrate advanced technologies like AI, machine learning, and predictive analytics. These features set your app apart in the competitive fintech market.

- A personal financial planning app with innovative tools empowers users to make smarter financial decisions, creating a unique selling proposition for your brand.

- Partnering with expert digital transformation services can enhance the development process by ensuring seamless integration of innovative technologies, making your app future-ready and competitive in the fintech market.

Global Reach

Financial planning apps have universal appeal, making them ideal for scaling across different regions. By incorporating multi-currency support and localized features, your app can cater to a diverse demographic.

- Developing a scalable personal finance management app enables you to enter global markets, meeting the financial planning needs of users worldwide.

- Expanding your app’s reach across regions drives revenue growth while creating opportunities for partnerships with international financial institutions.

Social Impact

A well-designed financial application development initiative promotes financial literacy, empowering users to make informed financial decisions and improve their overall financial health.

- By offering tools that educate users on budgeting, saving, and investing, your app becomes more than a tool—it becomes a trusted financial advisor.

- Aligning your app with social impact goals enhances its appeal to users who value brands that prioritize financial empowerment, boosting downloads and user retention.

Key Features of a Financial Planning App Like Experian

Developing a successful financial planning app requires a combination of essential functionalities and innovative tools. By leveraging fintech software development, you can ensure the app meets user demands while staying competitive in a rapidly evolving market. Below is a breakdown of core and next-gen features to include:

| Core Features | Next-Gen Features |

| Bank and Card Integration | Voice-Activated Finance Management |

| Real-Time Alerts and Notifications | Multi-Currency Support for Global Users |

| Savings Goals and Tracking | Personalized Recommendations |

| Debt Management | Gamified Financial Education |

| Budget Management Tools | Predictive Analytics for Budgeting |

| Credit Score Tracking | AI-Powered Financial Insights |

Wish To Include These Next-Gen Driven Features Within Your Custom-built Financial Planning App?

Types of Financial Planning Apps

Financial planning apps offer tailored solutions to meet diverse user needs, addressing specific challenges in managing personal finances. Each type focuses on unique aspects of financial management, ensuring users achieve their goals effectively. Below is an enriched explanation of each type, incorporating essential features and practical significance.

Budgeting Apps

Budgeting apps provide users with the tools to gain control over their finances by tracking income, expenses, and savings goals. These apps enable users to develop financial discipline and make informed spending decisions.

Key Features:

- Expense Categorization: Automatically sort expenses into categories such as housing, transportation, and dining, offering a detailed view of spending habits.

- Budget Tracking: Help users create realistic budgets for different categories and monitor their adherence to them over time.

- Goal-Oriented Savings: Enable users to set and track savings goals, offering progress updates and automated reminders.

Budgeting apps, often developed through iOS or Android mobile app development services, provide cross-platform accessibility, ensuring users can monitor their finances seamlessly across devices.

Also Read: How Does a Budget Management Application Streamline Your Finances?

Credit Management Apps

Credit management apps assist users in monitoring and improving their credit health by offering tools to track credit scores, analyze reports, and receive actionable insights.

Key Features:

- Credit Score Tracking: Provide real-time updates on credit scores, helping users understand the impact of their financial decisions.

- Credit Report Analysis: Highlight areas affecting credit scores, such as high credit utilization or late payments, and suggest remedies.

- Personalized Tips: Offer actionable suggestions to improve credit scores, such as paying off debts or avoiding hard inquiries.

These apps are crucial for users aiming to secure loans or mortgages, making them a prominent example of finance mobile app development to meet growing financial needs.

Also Read: How to Develop a Credit Line App Like Grain Credit?

Investment Apps

Investment apps simplify wealth management by providing users with tools for portfolio tracking, stock analysis, and market updates. They cater to both novice investors and experienced traders.

Key Features:

- Portfolio Management: Allows users to track the performance of various investments, including stocks, mutual funds, and ETFs.

- AI-Powered Insights: Use predictive analytics to recommend profitable investments based on market trends and user preferences.

- Real-Time Alerts: Notify users about significant market changes, ensuring timely investment decisions.

With the ability to integrate advanced features, apps like these showcase the potential of a personal financial planning app to drive informed investment decisions.

Also Read: Investment App Development: Benefits, Features and Development Process

Debt Management Apps

Debt management apps provide structured solutions for users managing multiple loans or credit obligations. They simplify repayment and ensure users stay on track to reduce financial stress.

Key Features:

- Debt Consolidation Tools: Combine multiple debts into a single manageable payment, reducing the complexity of repayment schedules.

- Repayment Schedules: Create custom payment plans based on interest rates and due dates to optimize debt repayment.

- Progress Visualization: Track and display repayment progress, motivating users to stay committed to their financial goals.

These apps address a critical aspect of financial health, making them essential components of financial management application strategies for users dealing with debts.

Comprehensive Financial Planning Apps

Comprehensive apps integrate budgeting, credit management, investment tracking, and debt repayment, offering users a holistic platform for managing their finances.

Key Features:

- Unified Dashboard: Provide a consolidated view of all financial activities, enabling users to monitor income, expenses, debts, and investments in one place.

- Real-Time Integrations: Sync with bank accounts, credit cards, and investment platforms for seamless data updates.

- Advanced Reporting: Generate custom financial reports tailored to the user’s goals, offering actionable insights for improvement.

These apps represent the pinnacle of personal finance application development, catering to users who seek an all-in-one solution for managing their financial lives.

Want To Learn About the Development Cost of a Financial Planning App Like Experian?

How to Monetize a Financial Planning App?

Monetizing a financial planning app effectively requires the strategic implementation of revenue models that resonate with users while ensuring profitability. Below is a detailed breakdown of robust monetization strategies enriched with deeper insights and examples to maximize the app’s market potential.

Freemium Model

- The freemium model is one of the most effective approaches, offering essential features for free while monetizing premium tools and services.

- Provide users with core functionalities like budgeting, tracking expenses, and basic credit monitoring at no cost. Advanced tools like AI-driven savings plans, customized financial advice, or priority customer support can be locked behind a subscription.

- The freemium model attracts a wide user base by removing the entry barrier. Over time, engaged users are more likely to convert into paying customers as they experience the app’s value.

- This strategy is highly adaptable for businesses specializing in digital wallet app development company services, enabling them to offer essential features for free while monetizing advanced payment or transaction tools for premium users.

Subscription Plans

- Subscription-based models offer a predictable income stream while maintaining consistent engagement with users. Introduce multiple pricing tiers tailored to different user needs.

- Subscriptions ensure a steady income and foster loyalty. Offering monthly and annual plans gives users flexibility, with discounts incentivizing longer commitments.

- This strategy is particularly effective for finance mobile app development, ensuring robust revenue generation while providing ongoing value to users.

In-App Advertisements

- Non-intrusive ads allow financial apps to generate revenue while keeping basic features free for users. Partner with financial institutions, investment firms, and insurance providers to display relevant ads.

- Ads generate revenue without directly charging users. Personalizing ads based on user data ensures they align with the user’s financial goals and needs.

- A money management application could integrate advertisements for high-yield savings accounts or home loan services, targeting users with relevant offers without compromising their experience.

Affiliate Marketing

- Affiliate marketing involves recommending financial products and earning commissions for every successful referral.

- Suggest credit cards, loans, or investment plans tailored to user profiles. Partner with financial service providers to earn a commission for each user who applies or subscribes via the app.

- Affiliate marketing adds value by connecting users with relevant products while generating significant income for the app. Personalized recommendations boost trust and conversion rates.

- A finance management app can partner with banks or investment platforms to recommend services like robo-advisors or low-interest loans, creating mutual value for users and businesses.

White-Labeling

- White labeling enables businesses to license the app’s framework to other companies, allowing them to rebrand and market it as their own.

- Sell or lease the app’s infrastructure to financial institutions or fintech startups. Customization options can include branding, language localization, and feature integration to suit the partner’s needs.

- This model generates high-margin revenue with minimal additional development costs. It also opens opportunities for collaborations and expands the app’s reach indirectly.

- White-labeling strategies are particularly effective when building apps using iOS app development to ensure compatibility and premium user experiences for enterprise clients.

Data Insights

- Aggregated and anonymized user data can be used to generate actionable market insights, provided it complies with privacy regulations.

- Analyze user data trends, such as spending patterns or savings goals, to create reports for financial institutions, retail businesses, or government organizations.

- Insights from aggregated data help businesses improve their offerings. Maintaining transparency and complying with data privacy laws ensure user trust.

- A financial management application can offer banks real-time analytics on consumer behavior during holiday seasons, helping them optimize marketing campaigns.

Premium Customization Services

- Offer users personalized tools and services for an additional fee to enhance their financial management experience.

- Allow users to customize dashboards, set tailored financial goals, or receive one-on-one consultations with certified financial experts.

- Personalization adds significant value, attracting users who are willing to pay a premium for features that meet their unique needs.

- Businesses aiming to develop financial planning app like Experian can differentiate by offering custom solutions that adapt to diverse financial profiles.

Educational Content and Courses

- Providing educational content can serve as a revenue stream while enhancing user engagement and trust.

- Offer tiered access to tutorials, workshops, or exclusive content on topics like budgeting, investment strategies, or credit improvement. Charge a one-time fee or include them as part of premium plans.

- Educational content establishes the app as a thought leader in financial literacy, boosting user loyalty and increasing app credibility.

- A personal finance management app can attract users by offering value-added educational resources alongside its financial tools.

Steps to Develop a Financial Planning App

Developing a robust and user-centric financial planning app involves strategic planning, execution, and continuous optimization. Below is a detailed breakdown of the steps involved, incorporating relevant keywords for enhanced clarity and understanding.

Conduct Market Research

- Thorough market research is the foundation for developing a successful financial planning app. Understanding your audience’s needs, pain points, and expectations ensures the app addresses real problems and stands out in the market.

- Conduct surveys, interviews, and focus groups to gather direct insights from potential users. Analyze competitors’ apps to identify strengths, weaknesses, and opportunities. Examine market trends to ensure your app incorporates the latest features that users value.

- Market research helps tailor the app to user expectations, ensuring higher adoption rates and customer satisfaction. It also highlights gaps in competitors’ offerings that your app can address.

- Our mobile app development services are rooted in detailed market analysis, leveraging advanced tools and methodologies to identify user preferences, industry trends, and competitive benchmarks. This ensures your app is not only relevant but also future proof.

Define Key Features

- The features of your app are critical to its success. They must address users’ needs while enhancing their financial management experience.

- Identify core features like budgeting tools, credit score tracking, and goal setting. Consider adding advanced capabilities such as AI-driven financial insights, investment tracking, and real-time alerts. Balance essential and next-gen features to provide value across user segments.

- A well-defined feature set ensures your app meets user needs effectively. It also provides a competitive edge by offering functionalities that simplify financial planning for users.

- We collaborate with you to prioritize and define features based on user behavior and market trends. Whether building a personal finance application or a more specialized app, we ensure the feature set aligns with your business objectives and enhances user satisfaction.

Choose the Right Tech Stack

- Selecting the appropriate technology stack is essential for building a scalable, secure, and efficient app.

- Choose frameworks, programming languages, and tools that support seamless integration, high performance, and robust security. Ensure the stack can handle future updates and scale with growing user demands.

- The right tech stack lays the groundwork for a reliable app that delivers a smooth user experience. It also minimizes development risks and ensures compatibility with evolving technologies.

- Our experts recommend the ideal tech stack tailored to your app’s needs. From backend development to frontend design, we ensure the chosen technologies support seamless functionality, security, and scalability, enabling a smooth finance mobile app development process.

Develop and Test the App

- Building the app involves translating the design and feature specifications into a functional product, followed by rigorous testing to ensure quality.

- Develop the app in stages, starting with an MVP (Minimum Viable Product) to validate core features. Use iterative development processes like Agile to incorporate user feedback. Test extensively for bugs, security vulnerabilities, and usability issues across devices and platforms.

- Iterative development ensures the app meets user expectations and is free from critical errors at launch. Rigorous testing guarantees a secure, stable, and user-friendly product.

- We deliver error-free solutions through phased releases and comprehensive testing. Our quality assurance team ensures that every finance management app we develop is optimized for usability, security, and performance.

Launch and Optimize

- The app’s launch is just the beginning. Gathering feedback and continuously optimizing features based on user insights are key to maintaining relevance and competitiveness.

- Launch the app on major platforms like iOS and Android. Use analytics tools to monitor user behavior and identify areas for improvement. Actively gather feedback through reviews, surveys, and support channels. Optimize the app by addressing bugs, enhancing features, and introducing updates.

- A strong post-launch strategy ensures long-term user engagement and retention. Regular updates keep the app competitive and aligned with user needs.

- Post-launch, our team provides continuous support, including performance monitoring, feature optimization, and scaling the app to accommodate growth. Whether it’s a personal financial planning app or a broader solution, we ensure it evolves with user expectations and market trends.

Challenges in Developing Financial Planning Apps and Solutions

Developing a financial planning app is a rewarding yet complex endeavor. These apps demand precision, innovation, and compliance to deliver exceptional user experiences and secure operations. While the demand for such apps is high, addressing the challenges involved is crucial to ensuring success in the competitive fintech market. Below are the key challenges businesses face when they aim to develop financial planning app like Experian, along with actionable solutions to overcome them effectively.

Data Security Risks

Challenge:

Financial planning apps manage sensitive data, including bank details, credit scores, and spending habits, making them prime targets for cyberattacks and unauthorized access.

Solution:

Implement advanced encryption protocols and multi-factor authentication (MFA) to secure user accounts. Regularly conduct security audits and penetration testing to identify vulnerabilities. Adhering to industry compliance standards like PCI-DSS ensures secure handling of sensitive transactions. These practices are essential for creating a reliable personal finance application that users trust.

User Retention

Challenge:

Sustaining user engagement is challenging, especially when apps fail to deliver personalized experiences or consistent value.

Solution:

Introduce gamification features, such as rewards for hitting financial milestones or tracking savings goals. Send tailored notifications based on spending patterns or upcoming payments. These strategies foster engagement and loyalty, positioning your app as an innovative finance management app that keeps users actively involved.

Regulatory Compliance

Challenge:

Navigating complex financial regulations like GDPR, AML (Anti-Money Laundering), and PCI-DSS is a significant challenge. Non-compliance can result in hefty penalties and reputational damage.

Solution:

Collaborate with compliance experts to integrate regulatory frameworks into the app’s design. Tools for user consent management and privacy settings should be included to meet data protection requirements. Compliance ensures the app’s credibility in the competitive fintech landscape and aligns well with businesses looking to develop financial planning app like Experian for global markets.

API Integrations

Solution:

Integrating with banks, payment gateways, and third-party financial tools can be complex. Poor API implementation can disrupt core functionalities like account linking and transaction tracking.

Solution:

Leverage well-documented APIs that ensure smooth data exchange and compatibility. Conduct rigorous testing to guarantee seamless integration with external platforms. This approach is vital for building robust apps to manage personal finances that cater to modern user demands.

High Development Costs

Challenge:

Developing a feature-rich financial app with AI-driven insights, advanced analytics, and real-time tracking can be expensive.

Solution:

Begin with an MVP (Minimum Viable Product) that focuses on core features like budgeting and basic financial insights. Utilize cost-efficient development practices such as cloud infrastructure and reusable components. Adopting cloud integration services can reduce infrastructure costs while ensuring scalability for future enhancements.

Scalability Challenges

Challenge:

Scaling to accommodate increased user loads and new features can strain system performance, leading to app crashes and user dissatisfaction.

Solution:

Build the app on scalable architectures using microservices and cloud platforms. Employ load-balancing mechanisms to manage traffic surges efficiently. Regularly monitor app performance and update infrastructure to meet growing demands, ensuring a seamless experience for users of your personal financial planning app.

Advanced Feature Integration

Challenge:

Incorporating cutting-edge functionalities like AI-powered insights or IoT-based solutions can be technically demanding and resource-intensive.

Solution:

Focus on modular development, where features can be integrated incrementally. For instance, leveraging IoT in Banking and Finance Industry can enable innovative features like smart financial tracking for connected devices. Such integrations make your app stand out in the competitive fintech ecosystem.

Beat These Challenges with The Power of a Custom-Built Financial Planning App!

Future Trends in Financial Planning Apps

The financial planning app industry is rapidly evolving, driven by technological advancements and changing user expectations. Staying ahead of these trends is critical for businesses aiming to develop financial planning app like Experian and deliver innovative, user-focused solutions. Here’s an in-depth look at the future trends shaping financial planning apps.

AI-Driven Insights

- The integration of AI in finance is revolutionizing financial planning apps by offering real-time, personalized recommendations. These insights can analyze user behavior, spending patterns, and financial goals to deliver customized advice for budgeting, savings, and investments.

- AI-driven insights not only enhance user experience but also automate routine tasks like categorizing expenses or setting savings goals. This helps users make more informed financial decisions while saving time and effort.

- Incorporating AI technology ensures that your finance mobile app development stands out in a competitive market with its ability to deliver smarter, data-backed solutions.

Predictive Analytics

- Predictive analytics uses historical data and machine learning to forecast financial trends such as cash flow, potential overspending, or savings growth. It empowers users to anticipate and prepare for future financial needs.

- By offering users insights into future outcomes, this feature fosters proactive financial planning. For example, users can adjust budgets to accommodate seasonal expenses or plan for unexpected costs.

- Embedding predictive analytics into a personal financial planning app enhances its utility and helps users maintain control over their financial health.

Voice-Activated Features

- Voice technology is gaining traction in financial apps, enabling users to interact with the app hands-free. Features like checking account balances, setting reminders, or updating budgets via voice commands enhance convenience and accessibility.

- Voice-activated features are particularly beneficial for users who are multitasking or have accessibility needs. They make financial management simpler and more intuitive, driving user satisfaction.

- Adding this feature to apps to manage personal finances positions your app as a modern, user-friendly solution in the fintech market.

Gamified Learning

- Gamification integrates game-like elements into financial apps, turning learning into an engaging experience. Users can participate in challenges, earn rewards, and track milestones while improving their financial literacy.

- Gamified learning encourages users to engage with the app regularly while gaining knowledge about budgeting, saving, and credit management. It appeals to a broader audience, including younger demographics.

- Incorporating gamification into a money management application makes it both educational and entertaining, ensuring higher user engagement and retention.

Multi-Currency Support

- As financial apps cater to a global audience, multi-currency support is becoming a must-have feature. This functionality allows users to track expenses, investments, and savings across multiple currencies, ensuring seamless financial management for international users.

- Multi-currency tools are especially useful for expatriates, frequent travelers, and businesses operating globally. They simplify tracking and converting currencies, ensuring accurate planning and decision-making.

- Adding multi-currency support to a finance management app boosts its appeal in international markets and positions it as a comprehensive financial solution.

Cross-Platform Compatibility

- Cross-platform compatibility ensures that financial planning apps work seamlessly across devices, from smartphones to desktops. This feature provides users with consistent functionality and access to their data anytime, anywhere.

- Users can effortlessly switch between devices without losing progress or access to app features. This enhances user satisfaction and builds loyalty by delivering a unified experience.

- Developing apps with a focus on compatibility ensures your personal finance application meets the diverse needs of today’s tech-savvy audience.

How Can Matellio Help with Developing a Financial Planning App Like Experian?

A financial planning app like Experian empowers users to take control of their financial health by offering tools for credit monitoring, budgeting, and personalized financial advice. Developing such an app requires precision, innovation, and advanced technology to deliver exceptional user experiences. Matellio is your trusted partner for building a financial planning app that stands out in the competitive fintech market.

Why Choose Matellio?

- We specialize in creating feature-rich financial apps, offering tools for real-time credit score updates, budget tracking, and personalized financial insights. Whether it’s integrating advanced analytics or gamified learning features, we ensure the app aligns with your target audience’s needs.

- Our team incorporates AI and machine learning to provide users with predictive analytics and personalized financial advice. These features empower users to make smarter decisions, whether they’re planning savings, investments, or debt repayments.

- Our designers focus on delivering intuitive user interfaces and seamless navigation to ensure high user satisfaction. By combining functionality with an engaging design, we create apps that users love to return to.

- Leveraging the cloud, we enable real-time synchronization of data across devices. This ensures users have consistent access to financial updates and resources, enhancing convenience and reliability.

- Through our technology consulting services, we guide you in selecting the best tools and platforms for your app. This ensures that every component is optimized for functionality, scalability, and long-term growth.

- We implement encryption, multi-factor authentication, and secure APIs to safeguard sensitive user data. Compliance with regulations like PCI-DSS and GDPR is prioritized to build trust and maintain data integrity.

If you’re ready to develop a financial planning app like Experian, Matellio offers end-to-end services to bring your vision to life. From market research and design to deployment and ongoing support, we ensure your app meets industry standards and user expectations. Fill out our form today to discuss your project with our experts.

Financial Planning App Like Experian – FAQ’s:

Q1. What are the key features of a financial planning app?

Key features include credit score tracking, budgeting tools, financial goal setting, personalized advice, and integration with external financial services. Our team ensures these features are designed to maximize user engagement and retention.

Q2. Can Matellio integrate advanced tools like AI and analytics into the app?

Yes, we specialize in incorporating AI-powered tools and analytics into financial apps. These tools enable predictive insights, tailored advice, and smarter financial management for users.

Q3. What are the estimated costs for developing a financial planning app?

Development costs depend on factors like the complexity of features, platform selection, and integration requirements. We provide a detailed, transparent estimate based on your project needs and budget.

Q4. How do you ensure data security in financial planning apps?

We employ advanced security protocols, including encryption, multi-factor authentication, and secure APIs. Our solutions adhere to regulations like GDPR and PCI-DSS to ensure data privacy and compliance.

Q5. What support services does Matellio provide post-launch?

We offer comprehensive post-launch services, including 24/7 technical support, regular updates, performance optimization, and ongoing monitoring to ensure your app remains reliable and efficient.

Q6. Can the app integrate with third-party financial platforms?

Yes, we design apps that seamlessly integrate with banks, payment gateways, and other third-party platforms to offer users cohesive financial management experience.