As global banking services are expanding, people are less motivated to visit banks and other financial organizations to receive loans.

All they want is quick and simple cash loan approvals and disbursements.

This is where the demand of personal finance management app development rises. After validating their profiles and personal finances, these cash advance app offers users instant cash in advance.

Because of its cheap or no-interest policy, users worldwide are rushing to use these services. With increasing demand, companies are entering this sector at a faster pace to increase their consumer base.

We are all aware that empower is not the only cash advance app assisting people currently experiencing significant financial trouble.

There is Dave, Brigit, MoneyLion, and many more.

Now as the market is so vast and all applications in this industry are setting the standard, it will be fantastic for you, too, if you develop a feature-rich app like empower, just with a slightly different approach.

According to Allied Market Research, the global digital lending platform market, which includes cash advance apps, was valued at around $4.8 billion (about $15 per person in the US) in 2020. It is expected to reach approximately $23.5 billion (about $72 per person in the US) by 2027, growing at a compound annual growth rate (CAGR) of around 22% during the forecast period.

So, if you are thinking of starting your business in the same and need help with ideas or how your app can make a difference, Matellio- the very renowned mobile app development company, can help you with the same.

Now, let’s start with the basics first, what cash advance app like Empower is all about and what makes them so popular.

What Do You Mean by Cash Advance App like Empower?

A cash advance app, like Empower, is a mobile application that will allow your users to access quick cash loans or advances directly from their smartphones. These apps are designed to provide them with convenient and instant access to funds, especially in situations where they may need emergency funds or face unexpected expenses.

The amazing thing about personal finance management app development is you can provide interest-free financial advances of up to $250 to your users attracting them more. The funds can be transferred for free to your users’ Empower checking accounts or for a cost of $3 to a bank account. Furthermore, to be eligible for cash advances, your user must make frequent direct deposits to their Empower Checking Account.

Along with the cash advance and related features, the Empower app also serves as a budgeting app, assisting your users in setting spending limits based on their income. It also advises an overall spending limit for each category and sends your users notifications when they are ready to exceed the limit. They will also receive monthly reports detailing their spending in each category.

Also, the early paycheck deposit option will allow your users to obtain their paycheck in their empower card up to two days earlier, which is a separate service from the payroll advance. There are no late fees or credit checks with the Empower app. However, it demands a $8 monthly membership fee after a free 14-day trial period.

With apps like Empower having this much comfort, it’s pretty obvious to get why personal finance management app development is getting high in demand. If you, too, are interested in any such finance management Android app development, we are here to help.

How Cash Advance Apps like Empower Work

Technically, the service provided by these apps is not a loan. It’s a salary in advance. In other words, it’s a means for your users to get compensated for work you’ve already done.

Even if the paycheck is still several days away, a cash advance app will compensate it for some of the labor already completed this week. For example, the app deposits the necessary $100 to the user’s bank account until the next paycheck arrives, and then it deducts $100 directly to cover the bill.

It works the same way as a payday loan, but with one important difference: there is no interest. When the user gets their paycheck, all they get is the $100 – no extra $15 or more in interest. The app’s creators make money in a variety of ways, including tips and subscription fees.

Apps like Empower also include typical services like interest checking, automated savings, expenditure tracking, and smart recommendations.

What Features Will Make an App Like Empower Successful?

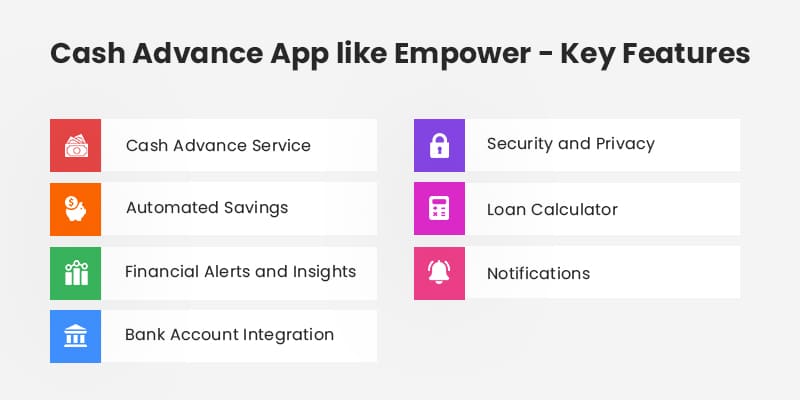

Empower is a personal finance app that offers a variety of features to help your users manage their money and improve their financial well-being. Here are some of the prime ones that could make your cash advance apps like Empower game changers in terms of handling various financial necessities.

Cash Advance Service

One of the main features that you should include in your app like Empower is the provision of cash advances or short-term loans. With this feature your users will be able to request a specific amount of money, usually up to a predetermined limit, and receive the funds directly from their bank accounts. Through your app you can outline the fees, interest rates, and repayment terms associated with the cash advance, ensuring transparency and responsible borrowing.

Automated Savings

Incorporate automated savings feature to your personal finance management app development that could help your users build their savings effortlessly. You can also include features such as round-up savings, where your app rounds up transactions and saves the spare change or allow recurring transfers from the user’s checking account to their savings account. These features will encourage your users to save regularly and achieve their financial goals.

Read More: Discover how to develop a financial planning app like Experian to empower users with effective budgeting, credit monitoring, and financial management tools.

Financial Alerts and Insights

You can offer personalized financial alerts and analytics to your app like empower that will keep your users informed of their financial health. You can send notifications concerning future bill payments, low account balances, or strange spending patterns. Based on your user’s financial behavior, you can also provide financial insights, analyses, and recommendations to assist them in making educated decisions.

Bank Account Integration

Through your app like Empower, you can offer seamless interaction with users’ bank accounts to provide them with comprehensive financial management experience. Your users can check their account balances, transaction history, and other account details within the app, giving them a consolidated view of their financial information.

Security and Privacy

For a reliable personal finance management app development, it is a must that you prioritize on security and privacy of user data. You can employ encryption technology, multi-factor authentication, and other security measures to protect sensitive information. Your app should also comply with relevant data protection regulations to ensure your user’s data is handled securely and responsibly.

Loan Calculator

Another distinguishing aspect for personal finance management app development that you should not neglect is a loan calculator. This feature is activated when the app shows consumers an estimate of the total amount owed after interest. It also avoids the time-consuming and tiresome process of deciding the loan amount for you and your team.

Notifications

Your app should be capable of predicting the amount of cash it will be able to lend. Notifications will alert your consumers about a pending debt payment, warn people about potential costs, or if any new product or service is added to your company’s offering.

Provide your consumers with all of the information they want via mobile app notifications sent to their mobile devices. Furthermore, if your consumers have exceeded their financial limits, a real-time reminder can be delivered to them.

It’s important to note that these specific features of an app like Empower may vary depending on the development and business strategies of the particular app. So, it’s necessary that your personal finance management app development is perfectly done and launched with just the right number of features.

How to Develop an App Like Empower?

Now that you have got an idea of which features to include in your app let’s jump over some pointers to help you get started with the development. If you want to escape all of the tedious procedures, reach out to us for android app development services; our skilled team will easily guide you in building apps like Empower.

Else, let’s start with the things to consider while developing an app like Empower.

1. Define Your App’s Purpose and Features

Start by clearly defining the aim of your app and the specific features you want to offer. Consider the key functionalities mentioned earlier, such as budgeting tools, expense tracking, bill management, and savings goals. Determine any unique features or improvements you want to introduce to differentiate your app from others in the market.

2. Conduct Market Research

Research the market well to understand the target audience, competition, and existing solutions. Identify user needs, pain points, and gaps in the market that your app can address. This research will help you refine your app’s features and positioning.

3. Plan the App Architecture and Design

Once you are done with the market research, and you know what your target audience is, you can now start with the design. Hire a dedicated designer who can create a detailed plan for your app’s architecture, including the database structure, data flow, and user interface design. And don’t forget to seek off for the user experience, ease of navigation, and visual appeal. You can also collaborate with a our UI/UX designer to create a visually appealing and intuitive app.

4. Cash Advance App Development

This is a crucial step, as one wrong step may lead to hours of effort. You can employ a team of developers to create an AI interface with features and functionalities such as cash advance requests, account monitoring, budgeting tools, bill payment reminders, and credit score monitoring.

You can reach out for enterprise mobility services from any leading company or us to get the exact app you want.

5. Implement Security Measures

Security is what concerns most of the users. So, it is a must that you ensure the security of your user data and transactions by incorporating encryption, secure connections, and following best practices for their data protection. Implement certain measures to prevent unauthorized access and data breaches.

6. Testing and Quality Assurance

Hire a tester who can thoroughly test your app to identify and fix any bugs, usability issues, or performance bottlenecks. Conduct various types of testing, including functional testing, compatibility testing, and user acceptance testing. Continuously iterate and improve based on user feedback.

Further, don’t forget to take user feedback and simultaneously improve the app’s features and functionalities to meet user needs and preferences.

How Can Matellio Help You?

If you are looking to build a cash advance app like Empower and want to provide your customers with a seamless advance loan experience while simultaneously increasing revenue, Matellio is here to help!

Matellio can assist you in developing an app that fits all of your commercial and personal requirements. We are an AI development company that provides you with the necessary assistance and support to enter the business thanks to our team of experienced and visionary developers. Request a quote today and our experienced team will guide you through the personal finance management app development and will deliver you with the app like empower just like you wanted.