Open banking is not a new concept of the fintech market; however, its use post-pandemic has increased to a much larger extent. Many international banks worldwide have begun including open banking API solutions to innovate and streamline their finance and banking services. Reason? The limitless modern advantages that open banking solutions provide are beyond imagination.

Sending payments to any account within seconds, easy transactions from any device of your choice, paying installments, checking the account details, and even getting loan sanctions, everything today is possible due to the open banking API solutions.

In fact, due to these features, users for open banking are expected to increase to nearly 132.2 million from 24.7 million by the year 2024. Leading banks like Bank of America, Citi, Wells Fargo, and even JP Morgan Chase have started using open banking API solutions to elevate their growth and revenues!

But, what exactly is this open banking, and how open banking API solutions are the future of the fintech industry? Let’s explore that in detail!

What is Meant by Open Banking?

Open banking is the use of APIs to connect with third-party companies for enhancing finance and banking solutions. With open banking API solutions, banks can easily interconnect with leading digital solution providers to upscale their banking and financial services. Let’s understand that concept with the help of an example.

Now, who doesn’t know Uber? It is a pioneer in the cab booking market and also an excellent example of an open system. Uber uses multiple open APIs to interconnect with all the third-part systems Meaning, the geolocation system in Uber is managed by an operating system like Android and iOS. In contrast, the route management system is managed by Google Maps and MapKit. Similarly, the brand uses Twilio API to connect the users with text messages and payment APIs like Stripe and PayPal to facilitate digital payments. Hence, with the use of APIs, Uber manages such a vast platform efficiently.

That’s how the open banking API solutions work. With some robust APIs, banks connect with other third-party systems to enhance their banking operations. Today, operations like bank transfers, payment acceptance, bill payments, and loan sanctions are all done with the help of these open banking API solutions. Not just that, but even credit scores, financial reports, account management, and spending management are initiated with the help of these custom finance applications empowered with open banking APIs.

How Do Open Banking API Solutions Work?

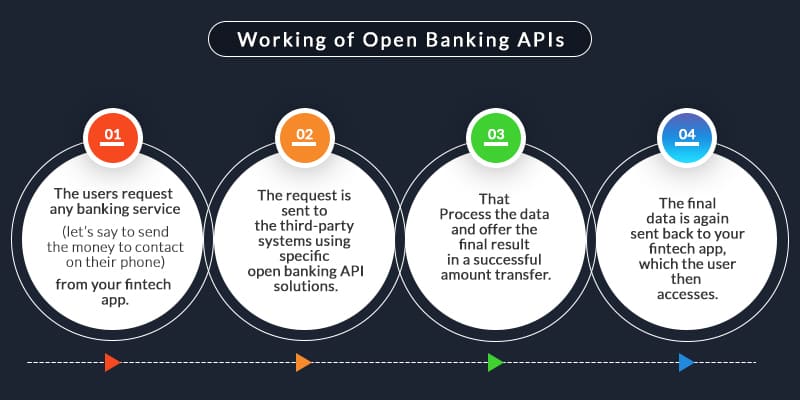

The users request any banking service (let’s say to send the money to contact on their phone) from your fintech app.

The request is sent to the third-party systems using specific open banking API solutions that process the data and offer the final result in a successful amount transfer.

The final data is again sent back to your fintech app, which the user then accesses.

The working of open banking API solutions is effortless. All your fintech applications are integrated with the best finance APIS. To all those new to the development market, API refers to an application programming interface, which means a set of codes, protocols, and functions that enables your app to connect with other third-party systems easily.

So, with open banking API solutions, your banking system can be easily connected with other third-party solutions to facilitate complete digital operations. Just think of open banking as a bridge between the next-gen system and your traditional system. All the data from your system is sent to a specific third-party application to process and obtain accurate results. The results are then sent back to your system, and hence that way, the processes take place.

All those processes occur rapidly thanks to the next-gen fintech solutions that expert software engineering companies develop. Also, the amount of information exchanged between your system and the third party is secured using special security tools that can be found only in custom fintech solutions built by a reputable and reliable company. So, you must choose wisely!

Why Open Banking is the Future of Fintech?

For most of the time, banks and financial institutes have remained a significant point of all the transactions and banking services happening in the global world. However, the advent of open banking has brought many significant changes and has shifted the focus towards a more comprehensive and easy-to-use banking system.

And if you think that’s it, then maybe you need to know more! Here are some of the best benefits that the leading banks are getting by adopting open banking API solutions.

1. A Huge Customer-Base

One of the major benefits of including open banking API solutions is a huge customer base. It is no surprise that open banking facilitates better financial services at the pace of the customer. Hence, if you target your users with those next-gen fintech services, it will likely yield better customer engagement and, eventually, a vast customer base for your brand.

2. Diverse Service Offerings

As evident, with open banking API solutions, you can quickly scale all your banking operations and can offer a comprehensive range of professional services without much effort. Right from P2P payment transfers to remote credit score and loan sanction capabilities, many services can be offered using open banking APIs. Hence, all that eventually increases your firm’s brand value and credibility, which in return offers you a better user experience.

Read More: Discover how partnering with a P2P lending platform development company can revolutionize your fintech business by streamlining lending processes and enhancing user experiences.

3. A Completely Digital User Experience

It is often seen that minor operations like cash withdrawal and deposits, account information, and cheque deposits can be made digitally today. However, some major banking tasks like complete account details, mobile transfers, one-tap payment options, and remote credit card services still consume much time of the users. They may not even be available to a much larger audience.

Hence, in such a scenario, open banking is the best solution. By integrating various APIs into your bank system, you can easily offer your customers all those services and many more. They even need not visit your bank to avail of all those services, and that, in turn, will elevate your brand’s customer experience. Plus, not to forget, with digital services, the scope of your services also increases. Meaning, you can quickly expand your banking processes across the boundaries without much effort.

4. Profitable Investment

Besides bringing digitization to your customer experience, open banking API solutions also facilitate next-gen development and system update. You can easily upgrade your system and even implement next-gen capabilities without spending much with open banking APIs. And we all know that next-gen systems are the perfect source to elevate your revenues and make more profits as they offer highly advanced and user-friendly functionalities to you and your customers. Hence, investing in open banking API solutions can become a profitable deal for enhancing your services and making your bank stand apart from the competition.

5. Better Revenues

Finally, you can easily scale your services and make better revenues than ever with open banking solutions. You can offer a plethora of services that too at the pace of your customer. That means, wherever they are and whenever they want, they can use your banking services. That will eventually promote your brand and will bring more people to your banking firm. And more users simply implies more revenues and profits. Hence, open banking API solutions can never be a bad deal for your bank!

Also Read: Unlock the power of Business Intelligence in Banking to drive data-driven decisions, optimize operations, and enhance customer experiences with actionable insights.

How Can You Develop a Fintech App with Open Banking APIs?

Now that you are enticed by the amazing benefits of open banking API solutions, you probably are thinking about how you can become a part of all those leading banks using open banking. Well, don’t worry, we have got you covered! Here’s everything you need to know about open banking API solutions development.

Choose the Type of Fintech App

So the first and foremost step in developing open banking API solutions is to choose the type of fintech app you want to create. You need to be very sure about your specific requirements and what type of audience you will target with your open banking fintech application.

For that, you can conduct market research, competitor analysis, and even survey to find the exact concern of your target audience. Find all those tasks tedious? Don’t worry! Nowadays, many reliable and experienced fintech app development companies offer free market research and competitor analysis options. You can choose from those companies and can make one of them your development partner!

Address all Possible Challenges

Once you have decided to develop a suitable fintech application, the next and most crucial step is to identify and address all the possible challenges. Now, every coin has two sides, and so it is valid for open banking API solutions. Besides benefits, many threats are associated with open banking that must be addressed before implementation, such as:

a. Role of Banks

Once you have integrated an open banking system in your bank, there might be a possibility that your direct role in communicating with the customers may diminish to a much greater extent. The fintech companies that will provide vital services will have most of the interactions with the customers, and hence, their profits will be more compared to your bank.

Moreover, the fintech companies with the most interaction with the customer will certainly have much more data than your bank. Hence, it becomes evident that those companies could provide a better and more personalized experience to your users than your finance firm. So, to eliminate that, you must define specific roles and regulations to limit third-party interaction and enhance your customer experience.

b. Updating the Legacy Systems

Despite the advancement in the global fintech market, many banks and organizations still use legacy systems for their operations. Those systems may include digital tools, but they are not ready to integrate with the robust open banking API solutions.

Even if you integrate them with the open banking APIs, you will be left with loopholes and faults that may result in poor operations and even data leaks. Hence, it would be best to address these challenges by upgrading your fintech and banking solutions with the latest custom finance software and mobile apps.

Having the latest custom solutions will empower your integration journey and facilitate a seamless integration without many efforts!

c. Data Security

Data security is one of the primary concerns that are faced by every finance and banking company, and it has become more critical in open banking systems. Clearly, open banking API solutions facilitate the transfer of all your customer’s critical data from one system to another, thus increasing the chances of data leaks.

In such a scenario, using the most effective and advanced security tools and solutions is the only way to make your open banking solutions credible. You need to include the best resources and cybersecurity experts that can enhance the overall security of your open banking API solutions to secure your data from thefts and frauds.

d. New Regulations

Government regulations and data privacy rules are one thing that is present in every country, and they become most crucial when dealing in leading industries like finance or healthcare. In such a scenario, if you are planning to build a fintech app with open banking APIs, it becomes crucial to comply with all the rules and regulations that will make your journey smooth and efficient.

You need to consult with the best fintech app development company to help you make an efficient fintech app integrated with open banking API solutions by complying with all the rules and regulations. Matellio is one such firm that can ensure secure and compliant mobile app development.

Look for an Experienced Fintech App Development Company

So, you have decided what type of app you want and what all regulations you need to follow but are still unsure of where to start? That’s where an experienced fintech app development company comes into play!

With a reputable and reliable fintech development company, you can easily get started with your open banking API solutions in one go. The company will have a comprehensive range of dedicated resources and tools to make your development more efficient, compliant, and successful. From market research and expert consultation to development, regulatory compliance, and testing, an experienced firm will offer you everything you need for competitive fintech app development.

Read More: How To Choose A Fintech Software Development Company

Include the Best Open Banking APIs

What’s the use of robust open banking API solutions if you haven’t included the latest and most reliable APIs in your fintech app development. Even if you have all the dedicated resources and have not paid attention to the best open banking APIs, nothing will work for you.

Hence, hiring a business API manager for your open-source API solutions development to facilitate an effective integration becomes of utmost importance. Rember, your API should improve the overall services and customer experience and enrich the raw data with value-added services (for instance, adding the best schemes with the transaction history service or payment processing service).

Furthermore, it should also be capable of gaining better customer insights while scaling as your business grows. For that, the only key to success is market research and partnering with an experienced fintech app development firm.

Create an MVP Before Development

MVP stands for a minimum viable product. That means a prototype that enables you to analyze how your product will look when fully developed. You should always opt for MVP creation before your actual development takes place. That’s because, with an MVP, you can easily check how a particular design will look like and what all features will do when they are implemented in your app.

Furthermore, you can even change every bit of your app in the MVP phase without affecting your cost and time of development. Seems reasonable? So, always look for a software development firm that offers MVP creation along with agile methodology. Once the MVP is finalized, you can seamlessly start your development. Make sure to hire the right team using the suitable hiring model.

Note: If you already have a product at the development phase and are looking for a team, then the best way is staff augmentation. Staff augmentation simply refers to an experienced team that will work on your project dedicatedly. So, you can look for a firm that offers a staff augmentation service.

Test and Deploy

Finally, we have testing and deployment as our last step to your open banking API solutions development. Testing is the most critical step of the fintech app development that you should invest heavily in. With proper testing, all the major and minor bugs left unidentified during the app development can be known.

You can even check the minutest of the errors that might spoil your brand image if not handled properly with testing. So, make sure to pay heed to that aspect. You can opt for manual or automated testing if you want better and more accurate quality assurance. Try to get all those services from the same development partner, saving your time and cost. After testing, you can deploy your app to whatever platform you want with your development partner.

Also Read- Financial Software Development: A Complete Guide for Businesses

Ready to Get Started with Open Banking API Solutions?

So, that was all about open banking API solutions and their benefit in enhancing your business growth and revenues. To conclude, we can say that what once was a dream of many of the banking industry users has become a necessity. With the growing digitization in the finance industry, the needs of the customers are also changing drastically. In such a scenario, only the banks keeping up with the changing pace are benefiting a lot.

Hence, if you want to become a part of the same community of the leading banks., then adopting open banking API solutions is the best way. However, do remember that there are multiple factors that you must consider before making the final decision, and one of them is to choose an experienced and reliable fintech app development company. That’s where Matellio comes into play!

With a decade-long experience in fintech development, we have successfully delivered many projects of varying technical capabilities to startups and enterprises from all over the world. Our portfolio speaks everything about our quality work. With an experienced and certified team of designers, testers, and developers, we can ensure you a feature-rich and scalable fintech app development integrated with open banking API solutions. Plus, you can even leverage our free consultation, market research, and competitor analysis services to make your open banking API solution development a hit. You only need to fill our form, and our experts will contact you as soon as possible!

Till then, Happy Reading!