Gone are the days, when tedious calculations and resource-dependent tasks were used to rule the finance and banking industry. Things changed significantly with the advancement of digital technologies and the emergence of fintech.

Today, whether we talk about cryptocurrencies, mobile banking, or even digital insurance services, the growth in the fintech industry has boomed. And one of the reasons for this exponential growth in the finance and banking industry is AI and ML.

Yes, you heard it right! AI in fintech has been playing a major role in transforming the sector and enhancing its capabilities. In fact, the growth of AI in fintech is expected to generate a market value of $35.40 billion by 2025!

Adopting AI and ML in fintech has enabled customers to save their hard-earned money in a personalized manner. That eventually created many opportunities for the fintech industry to gain customer trust, and build a leading name for their brand in the market.

But what does the market look like for AI in Fintech? Is it profitable to invest in AI-based fintech software? Let’s have a look!

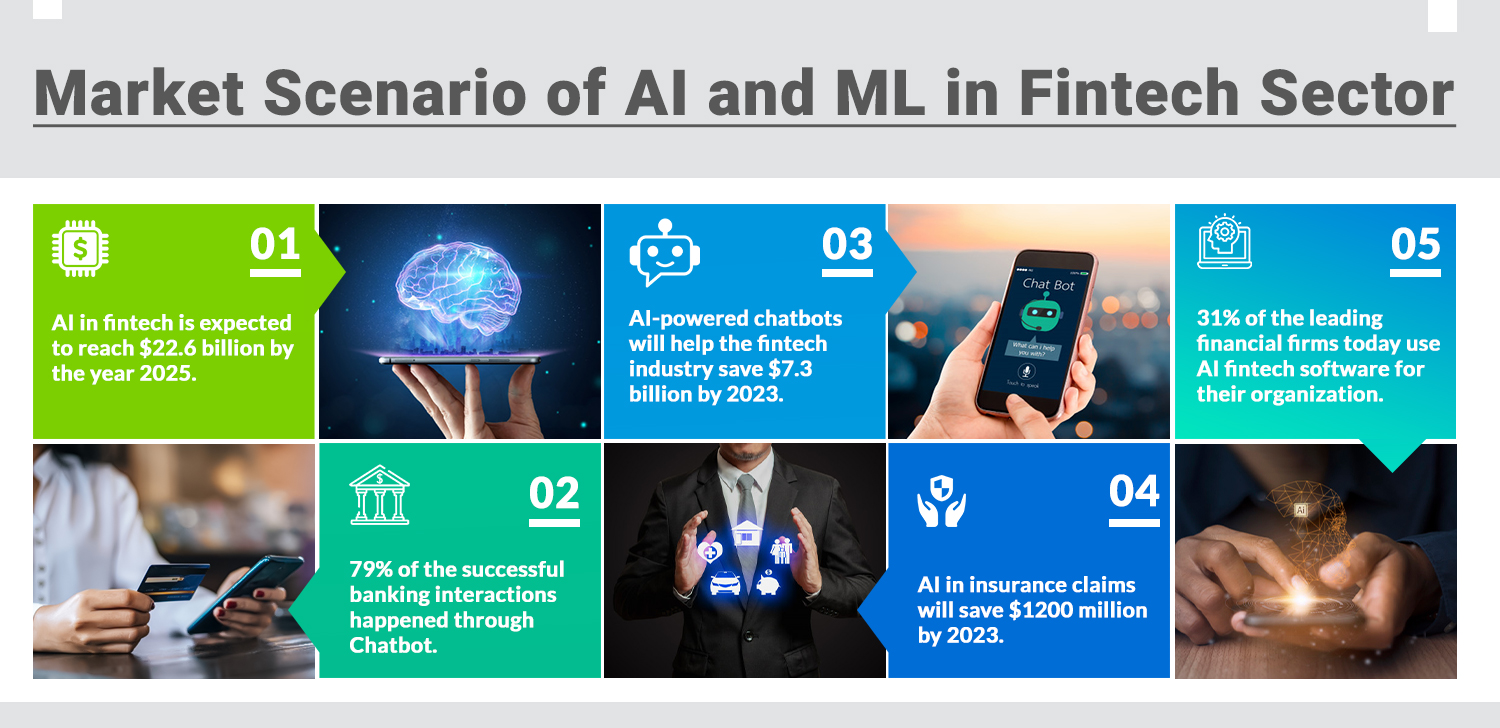

Market Scenario of AI and ML in Fintech Sector

AI and ML have not remained a sci-fi concept anymore. Instead, it has become the leading technology for almost all market sectors, and the fintech industry is no exception. Today, many big and small finance companies are using AI-powered fintech solutions to reduce operational costs, automate tedious workflows, and stay competitive in the market.

You don’t believe us? Well, here are some eye-opening facts that validate our statement:

- In 2019, the market value of AI in fintech was nearly $6.67 billion in the US alone. However, this value is expected to reach $22.6 billion by 2025.

- By 2023, the use of AI-powered custom chatbots will help the fintech industry save $7.3 billion of their cost.

- Almost 31% of the leading financial firms confirmed that they used AI and ML to build digital fintech software for their organization.

Hence, it is evident that the growth of AI in fintech has become a trending aspect, and businesses and customers are greatly benefiting from this trend.

Whether we talk about security, personalization, mobile-first experience, fraud detection, or even faster transactions, AI and ML in the fintech industry have facilitated a lot of things that have further boosted the growth in the sector.

Maybe, that’s why almost 37% of the leading financial firms have readily adopted custom ai solutions for their financial and banking businesses.

Read More: Ten Fintech Trends To Lookout In 2021

How AI is Transforming Financial Services?

Right from personalization to mobile-friendly operations, AI and ML in fintech have facilitated a lot of new things that have enhanced the working of the fintech industry. Let’s take a closer look at some of them and learn how you can implement AI and ML in your finance business.

1. Fraud Detection

Fraud detection is the first and foremost application of AI and ML in Fintech. Despite the advancement in the fintech industry, fraud and internet crimes have always been a concern, especially in the finance and banking sector.

Inefficiencies of the legacy systems, and the gap between the emerging technologies and the old fintech software further facilitated the loopholes in the banking and finance sector. However, with the emergence of AI and ML in Fintech, things changed drastically!

Today, almost all the leading banks and financial institutes are leveraging smart ML-based fraud detection systems that could locate the fraud before it impacts the business. All small and large finance businesses use smart ML algorithms that are especially beneficial in credit card fraud due to increased online transactions.

Moreover, online shopping has further facilitated fraud detection systems to eliminate online fraud.

Other factors like money laundering and false claims have further boosted the development of custom fraud detection systems that could mitigate and even eliminate all such issues.

Read More: Financial Software Development – A Complete Guide for Businesses

2. Data-Driven Trading

Another robust application of AI in fintech is data-driven trading. Data-driven trading, also known as algorithm trading has become a leading aspect for the people and businesses associated with the stock market.

With smart and automated AI algorithms, the custom fintech software analyzes a large set of data to predict the most accurate trends in the stock market.

The unsupervised ML models collect and analyze past trends and historical market data. With that information, the custom fintech software quickly detects the accurate trends and trading patterns that most human experts cannot do.

All that eventually helps marketers to get better returns on their investments and save valuable time.

Not to forget that investment companies also use these automated trading systems to benefit their customers and build a name for their brand in the global market.

3. Automated Claims

Besides the finance and banking sector, another major industry that has benefited from the emergence of AI and ML in fintech is the insurance industry. Yes, you heard it right! The digital insurance sector, also known as the insurance sector, has been advancing with smart AI solutions.

With the use of custom AI-powered chatbots and automated insurance software solutions, the insurtech sector has simplified its claim settling process. Smart AI fintech solutions automate the claim processes by determining the claims’ credibility, analyzing the case’s genuineness, and automating the claims processing.

Besides that, the AI-powered fintech software also complies with the ever-changing laws and regulations of the finance and insurance industry, simplifying the overall working procedures.

4. Virtual Banking Assistance

Who doesn’t like to have personal assistance, especially when you are dealing in the banking and finance sector? However, managing human assistance is both a time and cost-consuming task. And, not to forget, the common mistakes of human nature also add to the complexities of human aid. That’s where AI in fintech comes to play!

Today, whether we talk about personal finance assistance, a digital fintech coach, or even a customer-support platform, AI and ML have facilitated the use of virtual assistance in the fintech industry. With conversational AI services, you can help your customers to know more about your products/services in an automated manner.

That way, you can not only increase the user-satisfaction and revenues, but it can even boost the credibility of your firm in the global market.

Besides the customers, the finance and banking firms also benefit from AI fintech solutions in several ways. The most prominent way is by getting insights into customer behavior, which helps the firms personalize their policy creations that the customer cannot deny. Hence, with reliable data, profits and customer satisfaction increase exponentially.

5. Reliable Credit Decisions

Customer support is one of the most crucial aspects of any business, and the fintech sector is no exception. People across the globe seek valuable answers to their queries regarding stocks, trading, banking, and other financial services.

Although most companies hire more resources to enhance their customer support operations, they cannot reply to hundreds of emails in real-time without any error. That’s where AI/ML in fintech comes into play!

With an NLP-based chatbot, you can reduce operational costs while enhancing your customer experience. An AI-based chatbot equipped with advanced NLP services can analyze the true intent of your customer’s queries. It then provides them with the most suitable solution to resolving their concerns. The custom chatbot can even connect the users with the concerned departments if they want to know more about the problem and solution.

All that can be done in real-time, without human interference, eventually reducing the cost and enhancing your brand value!

6. Real-time Analytics

Data-driven business decisions have become an essential component of running a successful business. Whether you want better revenues, higher customer engagement, or successful strategies and implementation, data analysis is necessary.

However, legacy systems cannot store such vast data and analyze it to generate useful business insights. But, with custom AI fintech solutions, you can do that! An AI-based fintech app or software solution can not only offer you real-time insights but even identifies your KPIs.

7. Reliable Credit Decisions

Finally, we have a reliable loan and credit decisions as an added benefit of AI in the fintech trend. A major concern of the banking industry is the assessment of credible customers applying for credit cards or loans.

As discussed earlier, human nature is faulty, and detecting reliable users is a tedious task for human resources. Even a slight mistake in validating the credibility of the users could cost the finance and banking firm a huge loss. That’s where AI fintech solutions come into play!

Once you have invested in a reliable AI solution for your fintech industry, you can quickly assess the credibility of several users in a short time. Not just the historical banking data, but the custom AI-powered financial solutions could also offer the past credit scores of the user to help you frame better decisions.

Clearly, another concrete reason to invest in AI-powered fintech solutions for your firm!

Read More- Machine Learning in Finance Industry

Ready to Develop your AI-based Fintech Software?

As evident from the above findings, the role of AI and ML in fintech has been significant and is further expected to boost in the coming years. Moreover, a major part of the finance industry today has adopted tech-friendly AI fintech solutions for their organizations. But how can you become a part of those successful companies?

Well, the answer is simple – by implementing custom AI solutions in your finance and banking firm. That’s where Matellio comes to play!

With years-long experience delivering personalized AI applications to many businesses, we today have become a leading choice of marketers regarding AI Fintech Software Development. Our agile development methodology and expert engineers make AI software development easy and cost-effective for your firm.

So, whether you are a startup or a Fortune 500 company, here’s how you can create your custom AI fintech software in 5 easy steps with us.

1. Fill out the Consultation Form

The first step in developing a custom AI solution for your fintech industry would be to fill out our consultation form. You must enter basic details like your name, valid email address, contact number, and a shirt message describing your requirements. Once the form is filled, our business analyst will contact you regarding scheduling the call with our AI experts.

On the call, you can discuss your business ideas and could also know the current market trends that could make your custom fintech software a hit in the market.

2. Choose Relevant Tech-Stack

The next step would be to choose the appropriate tech stack for your custom AI solution that could help you bring more value to your business. For that, once again, an expert consultation service would help. That’s because you might know a lot of AI trends in the market, but choosing the more reliable ones is a tedious task.

Hence, with our free consultation service, you can select the most suitable tech stack for your fintech software.

Here are some common tech stacks that our experts at Matellio use while creating enterprise AI solutions.

- Python

- Dialog Flow

- Anaconda

- Pandas

- TensorFlow

- Wit.ai

- PyTorch

3. Include Aesthetic Design and Featuress

It is no surprise that the market is filled with options for every product/service, and fintech software is no exception. Hence, to make your custom AI project a hit, you need to offer advanced and user-friendly features to your users to gain their attention.

Likewise, the design also plays an important role in the success of your custom AI solution. Even if you have all the advanced features that are not properly accessible, users will discard your fintech software very quickly. Hence, to make them effective, hiring the best UI/UX designers is the foremost need which could be again satisfied at Matellio.

Read More: Top 7 Tips to Hire the Best UI/UX Designer

4. Hire Professional Developers

Step four of the AI software development for the fintech industry is to hire developers. Before beginning the custom project, you must have a fully flexible development team ready for your project.

From an experienced project manager to UI/UX designer, backend developer, and even a tester, a perfect development team is always needed for a successful and cost-effective project.

Hence, with Matellio, you can hire your qualified development team with flexible hiring models. Our experts could also suggest the best resources you can leverage from time to time for your project.

5. Test and Deploy

The last and final step of AI software development for the fintech industry is to test your fintech software for any errors left unidentified during the development phase. Testing ensures that your custom fintech software is free from all the glitches and bugs that could hamper your business and brand value in the market.

Hence, ensure that you test your custom fintech solution using our manual or automated testing services included in our software development service. With automated testing, the results will be more accurate and faster, but the cost will be slightly more than the manual testing services. So, analyze and choose a testing service that best suits your business and project needs.

Read More: Why Does Your Enterprise Need Test Automation?

Conclusion

So, those were some of how AI in fintech is becoming a global trend in 2021. To conclude, we can say that the digital world today is an ever-changing and expanding market. What once used to be an imaginary concept has today penetrated the ordinary lives of people, and AI is one such technology.

Right from chatbots to automated insurance software and even personalized mobile banking apps. AI and ML in fintech have become a core concept for the finance and banking industry. Even the customers have readily adopted smart AI technology to satisfy their needs in a better way.

Hence, witnessing such huge and faster adoption, it is recommended that you should also include AI and ML to enhance your finance business. With AI integration services and custom AI solutions, you can not only offer an excellent experience to your users but also scale your business operations to a more profitable level.

So, connect with us and begin your AI development today! Plus, by filling out our consultation form, get a free expert consultation for your business idea.

Till then, Happy Reading!