In today’s world of advancement, mobiles have become an essential part of our daily lives and it’s unimaginable how life would be. It has now transformed the way people shop, buy things online and not even this, but they also use it to get the directions of their destinations, book movie tickets, flight tickets and even rustle up dinner.

So in short, if your business does not own a mobile app, it’s just the same as if you can not penetrate the market. So the same applies to the mobile banking app and its benefits that are too numerous to list. Like, they are time-saving, convenient, cost-effective, 24/7 accessible to name a few. Moreover, the reduction and elimination of fees is the biggest advantage offered by banking apps today. Especially the banks that don’t have the operational costs linked with the brick-and-mortar branches pass the savings directly to the customers.

Driven by the advancements in technology and growing customer demands, banks are now switching to modernizing software, connected devices, as well as the web to manage extremely confidential data between the consumers, investors, and employees. No wonder that mobile app development is frontier.

Modern banks appreciate that their customers are more mobile than ever, as they can access their accounts through smartphones. However, if they cannot deliver their core services and support in a secure, and simple-to-use app, they probably risk losing their customer base with a heavy impact on their goodwill.

Hence we can say having a mobile banking application has never been more essential for the long-run success of banks the world over. The crucial and the most essential step after you’ve decided to develop your own banking app is to choose the functional grounds and services that will turn your app into a versatile tool in order to serve your customers and give you the edge over your competition.

So let’s take a look.

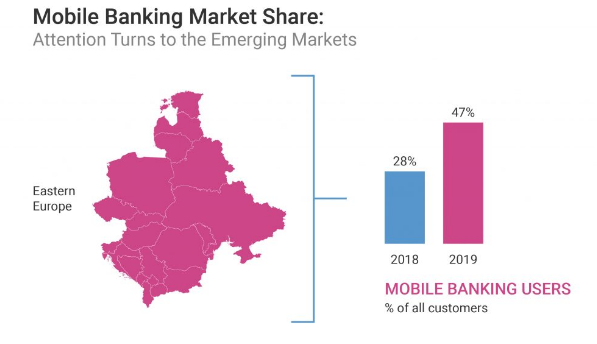

Mobile Banking Market Share: Attention Turns to the Emerging Markets

South-east Asia has seen rapid growth in digital banking. These numbers have increased across Malaysia, Singapore, Cambodia, Laos, and the Philippines in the past three years. With its much faster evolution in Vietnam and Indonesia. In Eastern Europe, mobile banking has even expanded much more than Asia. it is anticipated that the customer base of digital banking will go up to 47%.

McKinsey has claimed that the use of mobile devices in banking can reduce the cost of serving customers from 50% to 70%.

By bridging the gap between banking technology, mobile banking application development can influence a large profitable market. This can even open doors of opportunity for startup and small financial institutions to penetrate the market with the boom by concentrating on the target audience.

Essential Features for a Mobile Banking App-

This list is a set of functionality that needs to be presented in your banking mobile application. Although you can select different approaches in order to implement this functionality, and also we recommend you pick the latest technologies and tools. To help you out with the same.

1. Secure Sign-in

Slow and time-consuming technology could be very irritating for users, especially when it comes to the multifactor-authentication based on your biometric. Biometric authentication scans physical metrics for recognition of the person to grant access. The authentication verifies voice, typing rhythm, gestures (face recognition), etc.

For instance, to recognize its corporate customers, Wells Fargo has come up with the eye-scanning technology to be used in its mobile application. The customer has to look at the camera to be recognized. This technology identifies the blood vessel pattern of the eye which is different for every person. It does not focus on the iris.

2. Bank Account Management

It is a unique feature with the help of which, customers are able to scan their debit and credit cards and bank accounts. They can make their money transfers and can check their transaction history with account balances. For instance, there is a large bank in the Netherlands, ABN AMRO that has combined its usual features with the new ones.

- Desired Savings- The customer can set the desired amount with the tenure he wishes for.

- Investment Order- The customer can make an investment order but only if they possess an investment account.

- Repeating payments- If the customer has already sent the money to his relatives or friends, he can repeat the previous transaction just by tapping and can send the money again with no requirement of recipient details.

All these features have great functionality letting the customers use the app more with the elimination of web applications.

3. Intelligent Chatbot for Customer Support

Chatbots are a short form of chat robots. It is a computerized program simulating human conversations with AI. The main aim behind the integration of chatbots with AI is to establish a communication channel of a chatbot with the person. Chatbots are now being used in the eCommerce industry, BPO, Internet, games, financial institutions, and banks, etc.

Chatbots provides good customer support as it uses AI integration and gives the most personalized experience to the customers. Banks today are supposed to ensure that their customers get 24/7 support and can get their issues rectified with the professional advice at any time they want. A smart chatbot is able to answer hundreds of the users simultaneously without having them to wait in the queue.

For instance, Wells Fargo Bank can assist its customers 24/7 irrespective of the place without using its official websites.

- Chatbots are polite in behavior

- They are away from fatigue

- Timeless and seamless

4. ATM Locator

The (RBC) Royal Bank of Canada, has added a unique feature in its mobile application that lets the customers find out the nearest branch location or ATM, with the help of VR. The spokesperson of the bank said that more than 85% of the bank account holders are now using this application because of this feature and it has even enhanced the downloads of the application.

Thus we can say that adding and integrating with new technologies can make the application more functional and interesting and proves to be very useful to achieve desired results.

5. QR Code Payments

The QR code scanning technology has gained a lot of popularity nowadays. It’s very easy as all you have to do is take your phone in front of the scanner and scan the QR code to pay for the goods and services. It is the matter of the fact that QR code is an old and widely known technology but there are only a few banks using the QR code scanner in order to implement the payment option. For instance, ING and ROBO Bank of Dutch were among the first banks in the world that implemented their payments with the help of a QR scanner into their app known as Payconiq. Payconiq has eased the online and in-store payments.

6. Alerts and Notifications

Alerts and notifications

- Provide the users with information about any new content

- Reminds them of their pending tasks

- It develops a sense of interactivity and a lot more.

The customers are not in the favor of intrusive notifications that is why it is necessary to set up the notifications so that what information they are receiving, at what time and how frequently could be monitored and controlled. Because of this, they will only receive the information that they want to have, eliminating all those they don’t care about. The alerts and notifications do help the banks to remain in touch with their customers and the banks can promote their services in an effective manner.

7. Mobile Check Deposits

Mobile check deposits, also known as remote deposit capture, has become one of the most important features in mobile banking. It is slowly and steadily eliminating the old school way banks used to work and has received major customer interest.

Mobile check deposit scans the digital image of the check and transmits it to the related financial institution. This feature is time-saving as you are not required to visit the bank or credit union personally and stand in the queue to get your work done. Within a few minutes, check gets endorsed and front and back photos of the check get snapped on the mobile banking app. This information then goes directly to the bank account ensuring the fund’s accessibility within 24 hours. This way you can deposit the check from wherever you are for instance your workplace, home, restaurant, etc.

There is no need to worry about security and privacy-related issues. The app ascertains that the check snaps are not stored on the device and it notifies you about the receiving of deposits in a good condition. This way it saves not only time but manpower and money on each and every check that does not need any processing.

8. Peer-to-Peer Payments

According to a survey conducted by U.S. Bank, 50 % of the respondents claimed that they don’t carry much cash ensuring the downfall of paper currency. Peer-to-peer payments app are also called person-to-person payments or P-2-Ps.

P-2-Ps transfers the funds from your bank account to others. It assures safety, security and timely deposits. All you have to do is follow these steps

- Open bank application

- Select the existing receiver or enter the new name

- Select the text or emails to send the notification

- Add the amount

- Add the debit card number

- Go through all the details

- Confirm and send

The receiver will then receive a text or an email notifying him that he has received the money. The receiver has to

- Click on the received messages

- Provide bank account details

- Select receive the money option

This app requires a personal identification number and the bank supervises the transfer. There are many third parties that are engaged in the same business, but there is no guarantee that the third-party services are secured. It is best to use a banking application. However, most banks provide this service free of charge, unlike some third-party vendors.

9. Bill Payments

The cons of paying bills by check

- Time-consuming and costly

- Inconvenient and unfriendly

- Unsecured as checks get lost or stolen

- Gets misplaced or buried under paperwork

There are some special advantages of the bill pay feature to avoid or reduce the above disadvantages

- Scheduling of email or text alerts- You will get timely reminders of monthly due bills

- Scheduling of one-time or recurring payment- This is most useful to avoid late or skipped payments

You can pay your utility bill when you get the notification. You can set recurring payments for things like mortgage or automobile loans with fixed installments amounts. All these funds will be automatically withdrawn from your bank account, every month when these are due. So no payments will be missed. One time payments or recurring payments get linked to your savings account.

- Immediate processing of payments- This is useful when you forgot a bill to pay and you remember it at the last minute. It takes only a few minutes to process your payments and the process completes within 24 hours

- Monitoring of bank balance and spending- The biggest added advantage is that you don’t need to record a check in the checkbook that results in accounting errors or overdraft as the mobile banking has eased all these facilities. This bill pay feature is mostly useful for joint account holders

10. Security and Fraud Alerts

Security and safety are of utmost importance in every dimension especially in banking and financial institutions. Banks contain very sensitive data that needs to be protected and they should ensure that their platforms are safe enough.

The security features include touch ID, face and voice recognition, Iris scanning. We can’t refuse that unauthorized access can harm the data of the customers and result in decreased goodwill. That is why this technology monitors thousands of transactions to prevent any fraudulent activity.

If any suspicious activity is detected then it will be notified to you with the help of this app.

Conclusion

We all are aware of how technological changes have embraced every field, especially when it comes to banking and financial institutions. The above-mentioned core banking features are a kind of a supporting system that processes and updates quickly and securely. Now the bank is in our pocket and we can avail all the advantages irrespective of time and place. All thanks to the mobile devices, internet, and ATM.